5 Ways Early Tech Adopters Influence the Subscription Market

A small group with big impact—understanding the role of early tech adopters in the video ecosystem.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

5 Ways Early Tech Adopters Influence the Subscription Market

We’ve all seen them—the folks lined up in all kinds of weather for the newest tech gadget, the people who live stream the annual Apple event. And even if their friends and relatives give them the side-eye when they rave about the latest and greatest phone, tablet, or 4K TV, they still rely on these enthusiasts for recommendations, reviews, and sometimes tech support.

As a result, early tech adopters are hugely influential. They drive product releases and they will pay a premium to be the first to own. But because they don’t use tech like other consumers, the early adopters present both risks and rewards to companies as they develop and roll out new products and services.

In the most recent Hub TV Churn Tracker, we found that one in seven consumers describes themselves as “among the first to buy” new technology. But that small segment has a big impact across the video marketplace.

Let’s take a look at who the early tech adopters are and what we’ve learned about their video subscription usage. Here are some of our findings:

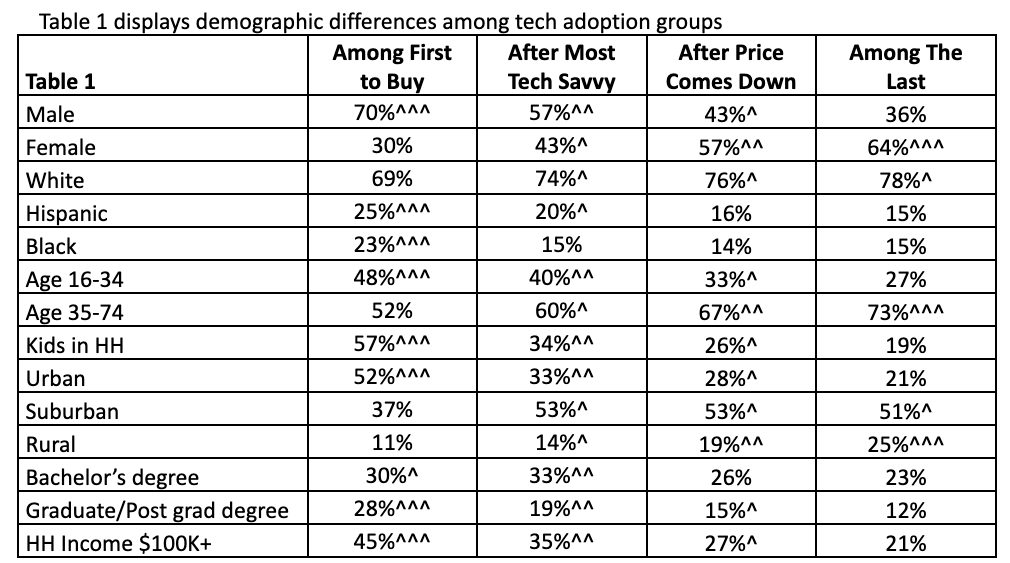

Young, urban, and non-white consumers are highly represented among first wave tech adopters.

The two earliest tech adoption groups outpace the lagging groups in TV subscriptions.

The first to buy technology and the consumers who buy just after the most tech-savvy surpass the other two groups on their usage of a wide array of TV services.

While it might not surprise you that those among the first to buy have higher sign-up rates for a vMVPD, they are also more likely to subscribe to “old school” MVPDs. And when they do subscribe to a multichannel service, they are significantly more likely to have at least one premium channel.

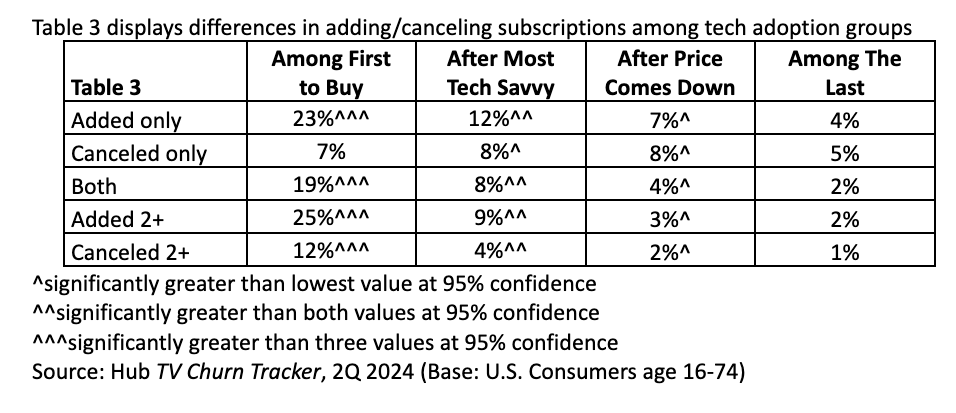

The earliest tech adopters add and cancel TV services at the highest rates.

The viewers who are among the first to buy new tech outpace all other groups when it comes to adding and canceling TV services. But twice as many of the early adopters added two or more services as dropped two or more in the previous month. In aggregate, the early adopters are net adders; a spot of good news for TV providers.

For the earliest tech adopters, adding services is about content AND value.

Most early tech buyers added a TV service to watch specific content but they are also attracted by a robust collection of content.

Although early adopters are the consumers willing to spend more on the latest tech, when it comes to TV, 42% were more likely to add a service because of lower cost or a promotional offer, and 24% said value spurred them to add, significantly higher than the other groups.

Sure, cost and value are important drivers of cancellation for early tech adopters, but so are technical glitches.

Across the board, cost and lack of use are the top reasons viewers cancel a TV service. But—surprise! The tech-savvy early adopters were the most likely to cancel a service because they experienced a technical problem or found it difficult to use.

It’s not a stretch to conclude that early adopters are less tolerant of services that are glitchy or not intuitive. And they’re the type of consumers who know they have other user-friendly alternatives to turn to.

Why video services need to pay attention to the early tech adopters.

Although they make up a relatively small segment of the market, early tech adopters are influential consumers in the video ecosystem. They spend more money, use more services, and they churn through them at a higher rate than more mainstream tech users.

But they don’t subscribe indiscriminately — they are among the most value sensitive consumers. They can be attracted by promotional pricing, — but they are quick to cancel a subscription if they don’t think they are getting their money’s worth. And they have little patience with poor user experience or lackluster customer service.

To retain this important group of consumers, streaming services need to promote fresh content and ensure that menus and recommendations are as seamless as possible.

Going to These Upcoming Conferences? Come Say Hi 👋🏼

CTAM Think: November 7, 2024 (New York City)

will present highlights from Hub’s Evolution of Sports study.Streaming Media Connect: November 12 -14, 2024 (Virtual)

Hub’s

will be on a panel moderated by discussing Emerging OTT Subscription Strategies.TVOT NYC: November 21, 2024 (New York City)

will present findings from Hub’s Battle Royale study and appear on a panel.Register here using the code above.

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com