Partners in Prime

Is Amazon Channels a growth engine—or a churn machine for streamers?

Hub Intel: Deep Dive reports are released monthly, delivering exclusive insights and in-depth analysis on key industry topics—available exclusively to paid subscribers. Paid subscribers also get access to a full premium report for download. Not a paid subscriber yet? Now’s the perfect time to upgrade! For just $5/month or $60/year, you'll receive expert-driven reports packed with exclusive data—plus full permission to cite, republish, and use the insights in your work.

Hub Intel Deep Dive: Partners in Prime

In today’s overcrowded streaming landscape, visibility is half the battle. While those of us in the business think of platforms as unique snowflakes, for most consumers it’s all a blur. Hub’s annual Evolution of Video Branding study shows that awareness of major streaming platforms is nearly universal. But far fewer viewers feel confident they could explain how one platform is different from another. This problem is even more pronounced for “niche” streamers—those without the marketing muscle to push their brand into consumer consciousness through sheer force.

That’s where Amazon Channels comes in.

Amazon Channels is now critical to the distribution strategy for SVODs. Amazon’s massive reach helps solve the marketing problem by surfacing content to customers already on the platform—shopping, streaming, and everything in between.

At the end of 2021, Amazon accounted for 41% of subscriptions to services like Paramount+, Discovery+, and Starz (according to Antenna data).

By the end of Q2 2024, 91% of niche SVOD subscriptions were made through some kind of aggregator. And of those, 58% came through Amazon Channels.

But this raises a big question for platforms:

Who are these Amazon subscribers—and are they replacing direct subs or expanding the pie?

We used Hub data to compare two key groups:

Prime users with Channels: Prime Video viewers who have at least one add-on subscription through Amazon Channels.

Prime users without Channels: People who watch Prime Video but haven’t subscribed to any add-on channels.

Here are four key takeaways from our research:

1. Prime Channels users really love TV.

Prime users with add-on Channels are more engaged TV viewers, period. 65% say that TV is an “essential” or “very important” part of their lives—compared to just 47% of Prime users without Channels.

2. Channels users are motivated by new releases.

One big advantage of partnering with Prime—especially for niche platforms—is Amazon’s ability to target users with specific content at the exact right time. That’s not just theoretical. The data backs it up.

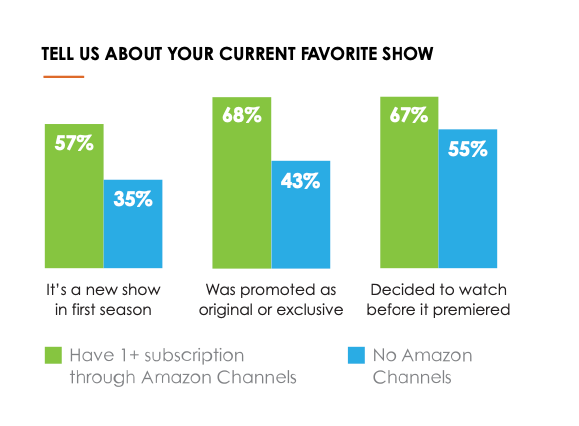

In Hub’s Conquering Content study, we asked respondents to tell us about a new show they discovered that’s become a favorite. Among Prime viewers with Channels, their favorite new shows were far more likely to be:

A new release: More than half said their show was in its first season (vs. only a third of Prime users without Channels).

An exclusive: Two-thirds said their show was original or exclusive (vs. fewer than half without add-ons).

Appointment viewing: Two-thirds said they planned to watch before the show premiered.

Overall, Channels users are more likely to spend the majority of their screen time watching brand-new shows they’ve never seen before—less comfort viewing, more exploration.

Keep reading with a 7-day free trial

Subscribe to Hub Intel: Entertainment Explained to keep reading this post and get 7 days of free access to the full post archives.