The Importance of Black Viewers in the Streaming Marketplace

Are media companies overlooking this valuable audience?

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

The Importance of Black Viewers in the Streaming Marketplace

Over the past several years, Diversity, Equity, and Inclusion programs have become one of the most divisive issues in the U.S. One state has literally banned the use of the term DEI in public education and government. In the world of entertainment, race-blind casting decisions are assailed as “woke” and consumers threaten boycotts in response. At the same time, DEI efforts seem to have stalled among the many challenges faced by big media companies, and many prominent DEI executives took their exits in 2023.

Against this backdrop, Nielsen recently released The global Black audience: Shaping the future of media report, examining the attitudes and TV consumption of Black viewers across 5 global regions. They found that although Black talent was more visible on TV in 2023 than ever before, two-thirds of Black viewers say they are not adequately represented on TV. Worse than that, however, is that nearly two-thirds of Black consumers believe when they are shown, they are often misrepresented.

Why is this important for media companies to acknowledge and address? Because Black consumers are more enthusiastic about TV and spend more time watching than other groups. They say TV is better than it’s ever been, they use more video platforms, and they spend more time with them.

The Hub TV Churn Tracker and Conquering Content studies clearly show the importance of Black viewers in the competitive video marketplace. Here are 4 key findings worth noting:

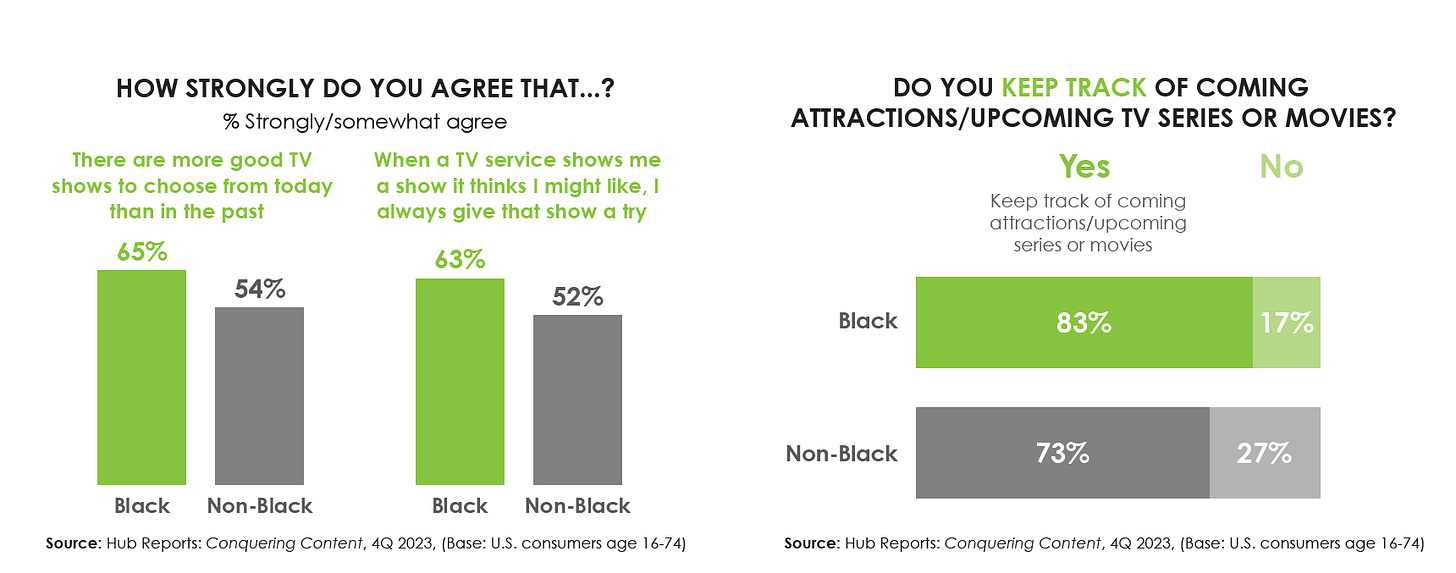

Black viewers say TV is better than in the past, and they like to try new shows.

Black viewers are the most likely to say there are more good TV shows today than there used to be, to try the shows a streaming service suggests, and take note of upcoming series and movies. And for this audience, behavior follows from their positive attitudes – Black viewers are the most likely to watch 30 or more hours of TV per week.

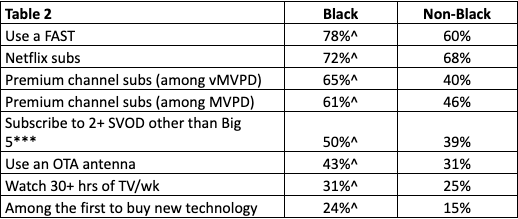

Black viewers are more likely than other groups to use virtually all video platforms.

Across the board, Black households are contributing to the purchase, subscription, and usage of entertainment sources at a rate beyond other groups. This goes for SVODs, FASTs, premium cable channels, as well as over-the-air broadcast TV.

Table 2 displays differences between Black and white viewers on media subscriptions and usage:

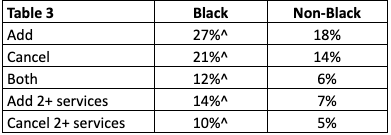

Black consumers add and drop TV services at a higher rate than non-Blacks.

Black viewers are also more likely to belong to the group Hub has dubbed “Swappers” – consumers who both add and subtract TV services in a typical month. And when they do make a change, they are more likely to add or drop multiple services.

With the video marketplace reaching maturation, and subscriber growth hard to come by, Black viewers represent both opportunity and risk for streamers. With so many services trading subscribers back and forth, it’s important to recruit as well as retain customers.

And what are Black viewers looking for when they add a service? “Always fresh” content is the main draw for those who sign up for a new subscription. Once again for this group, behavior corresponds with attitudes – they say they keep track of new series and movies, and they follow through by joining up for services that have them.

Table 3 displays differences between Black and white viewers in adding/canceling TV services:

Black viewers are too important and valuable an audience for streamers to take for granted.

At a time when the phrase Diversity, Equity, and Inclusion is enough to trigger an angry backlash, the entertainment industry needs to remain steadfast in making their offerings more inclusive for Black audiences. The road to profitability for streamers is already difficult enough, and overlooking an audience segment that highly values the content and subscribes to a wide array of services is risky business.

What That Means for the TV Industry

The way forward for the TV industry overall and video streamers in particular with Black audiences is clear. Continue to improve the representation of Black people both on screen and behind the camera, and tell stories that better represent their experiences. Ensure those endeavors are communicated directly to Black audiences. Sincere efforts to cultivate the loyalty of Black viewers can pay off in reduced subscriber churn.

It's not about being “woke.” It’s good business.

ICYMI: Hub in the News

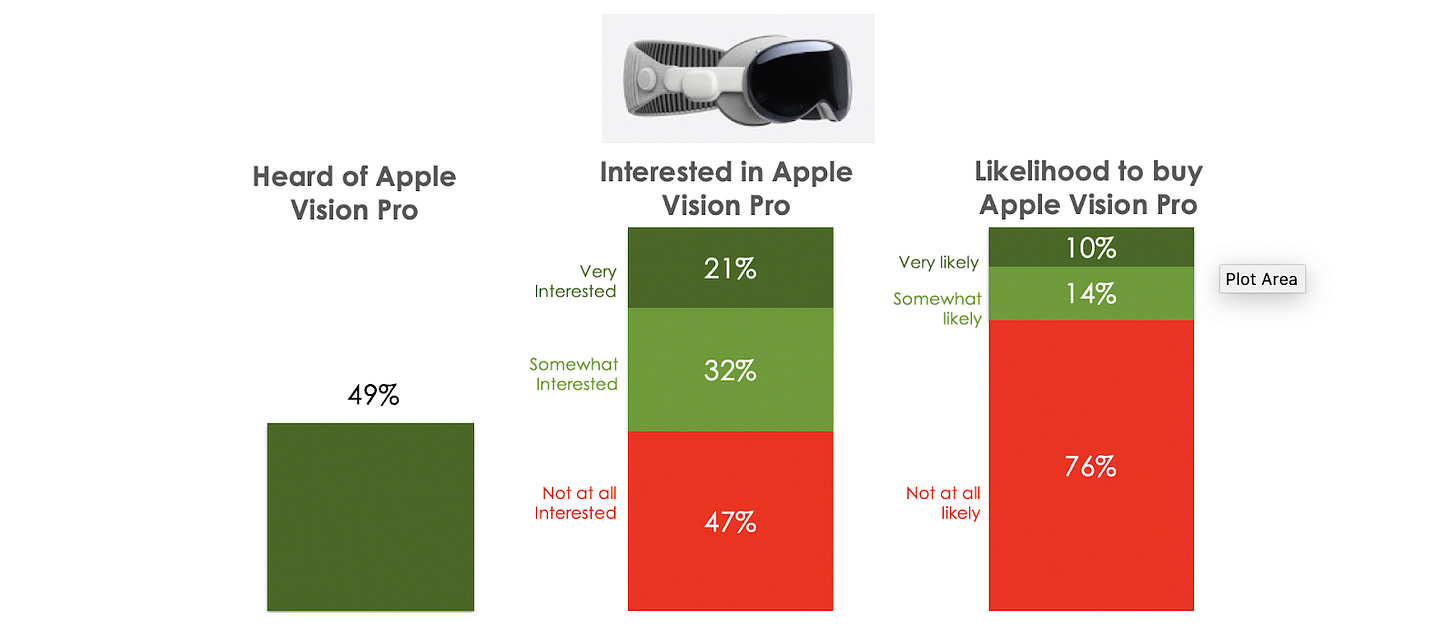

Smart TV ownership increases going into 2024 as the new Apple Vision Pro headset moves the needle on new tech.

“With more affordable and higher quality TVs available, it’s no surprise that people are continuing to upgrade their home theaters to better Smart TVs that make watching favorite streaming content easy. The exciting debut of the Apple Vision Pro headset is a big step toward making advanced headset usage more mainstream – although there is clearly room to grow in further integrating it into traditional living room behavior.” — Jason Platt Zolov, consultant to Hub and study co-author.

Leveraging Hub Entertainment Research’s annual Connected Home study, here are 6 takes on how streaming video growth continues to drive tech adoption.

Senal News: US: Smart TV Ownership Increased In 2024 as New Apple Headset Moved the Needle on New Tech

Advanced Television: Research: US Smart TV ownership rising

Yahoo Tech: Hub: Smart TVs Now in Nearly 8 of 10 Homes

TV Technology: Hub: Smart TVs Now in Nearly 8 of 10 Homes

The Streamable: Survey: Nearly 8 in 10 Homes Now Have a Smart TV as Streaming Dongle Usage Wanes

Media Play News: Hub: 80% of U.S. Homes Own a Smart TV, Consumer Demand for Apple Vision Pro VR Headwear Limited

Hub at ARF AudienceXScience

Check out Hub’s David Tice talking about the downstream effects from the transition to streaming via Smart TVs at ARF’s recent AudienceXScience event.

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com