Hey, Big Media: Where We Dropping?

Why Disney’s investment in Epic Games is a game changer for the entertainment industry.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Disney recently announced it had invested $1.5 billion in Epic Games, the studio behind Fortnite. This was well received on Wall Street and the stock price immediately rose 10%. The investment marks a defining moment for Disney and the entertainment industry as a whole. I predict we’ll look back on it in much the same way as we do on Netflix's launch of House of Cards in 2013. Here’s why:

Gen Z has a very different definition of “entertainment.”

Those of us old enough to remember “Must See TV” think about television as the center of the entertainment universe, but the next generation of consumers has a much broader definition.

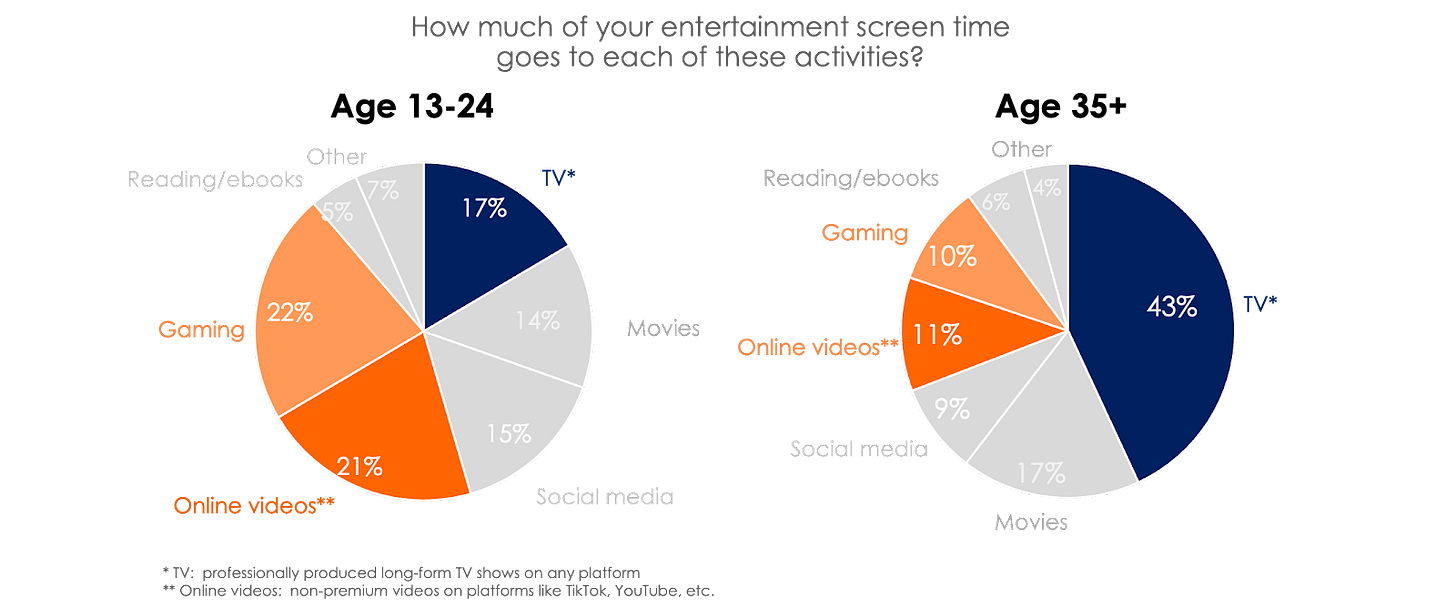

In Hub’s Video Redefined Study, we found that consumers aged 35+ spend an estimated 40% of their screen time watching TV shows and 10% on games.

Stats for Gen Z consumers aged 13 to 24 are very different. According to the study, they spend almost 25% of their time gaming and just 17% watching old-school TV shows. Gaming is embedded in their lives even more than TV was embedded in their parents’ lives. Hub’s study found that 70% of Gen Z consumers game every day and more than half game multiple times per day.

Games aren’t just content, they’re communities.

Gen Z will never “outgrow” gaming for one simple reason: they need it too much. In fact, games are more like utilities than entertainment. Hub’s study found that two-thirds of gamers under 35 use in-game chat to talk to their friends about school, relationships, and other things that have nothing to do with gaming.

Among those, 40% say that “most” or “all” of their communication with friends happens inside a game. Games are also how many Gen Z consumers make friends in the first place – 47% say at least one of their gaming friends is someone that they’ve never met in real life.

Fortnite is a particularly great example of this data in action.

There are more than 500M registered Fortnite users, and an average of about 15M active players on any given day. And they do a lot more than play – Fortnite partners with a list of brands and creators that defy categories – from Lego and Star Wars, to Ariana Grande and Travis Scott. In December, a live Eminem performance drew more than 3M simultaneous users, the most streamed event in gaming history.

It goes to show that for companies with IP to leverage, gaming pours gas on the fire.

In the post-Peak TV era, even great TV shows have trouble finding an audience – there are just too many to choose from. But TV shows based on familiar IP have a big advantage, and gaming IP in particular comes with a built-in audience.

In 2023, The Last of Us premiered on HBO and HBO Max and scored 4.7M viewers – the second biggest debut in the history of the network, after House of the Dragon.

Many were surprised that a show based on a 10-year-old video game performed so well, but they shouldn’t have been – 37M people played TLOU or the sequel game. Each person spent $60 on the game and spent 15-20 hours to complete it. With that much investment, I don’t find it at all surprising that so many people were willing to spend a little more time and money to watch a TV show based on that game.

Last year, Hub surveyed a sample of gamers who had played The Last of Us – 78% of them said they also watched the show, and almost two-thirds said that the game was the main reason they watched.

Sure, TLOU had the advantage of being a great show. But in the post-Peak TV era, plenty of great shows can’t break through the noise to find an audience. Big gaming IP offers a legion of invested fans who will tune in wherever that content lands.

So, why is Disney’s stake in Fortnite an industry game-changer?

The definition of success in TV is shifting from subscribers to engagement. The name of the game is to maximize the time and money each user spends on your platform, leaving as little as possible for them to spend elsewhere. You can’t maximize engagement with the next generation of consumers if all you have is video.

Disney is not the first media company to realize this. Apple and Amazon both bundle gaming, music, and more with their TV content. And Netflix continues to grow its gaming content – including licensing legacy Grand Theft Auto games right as the launch buzz for GTA6 starts to ramp up.

But Disney’s partnership with Epic offers greater synergies than any of these other moves by media companies to incorporate gaming. Here’s why:

Fortnite has a gigantic community that Disney and Epic can leverage into a content bundle. That includes gaming, streaming, events, and even visits to Disney’s parks.

Fortnite is constantly a “new release.” Those 15M daily users will play all the time. There’s no need to worry about keeping them engaged between seasons.

Games like Fortnite are the best possible environment to grow an ad business. Unless it’s the Super Bowl, viewers see ads in TV shows as an interruption to be tolerated. But ads in games are part of the experience - like a Mandalorian skin in Fortnite, or a car pack from Ford in Gran Turismo. According to Hub’s annual Gaming 360 Study 64% of those that play games with branded content say it actually makes the game more fun. Imagine a world where TV ads made the shows they’re in better? It’s a win-win for everyone!

Game over or Game on?

The writing is on the wall. The future of entertainment is in communities, not content – a place you belong rather than a thing you subscribe to. Companies with powerful IP will have more opportunities than ever to exploit it, but also a mandate to do that as fast as possible before someone else beats them to the punch.

Have an opinion about entertainment communities of the future? Drop a comment below.

ICYMI: Hub at Streaming Media Connect

Hub’s

and spoke at Streaming Media Connect. Check out their panels.No Quarter – Separating Fact From Fiction in the M&E Q4 Earnings Reports: Jon's panel delved into the deception within major media and entertainment companies' quarterly earnings calls, which often obscure unfavorable figures with expert rhetoric, while journalists seldom pose probing questions, followed by an exploration of the implications of the Q4 numbers for 2024.

Targeting, Measuring, and Scaling Connected TV Advertising: Mark’s panel explored why CTV advertising, despite not growing as fast as CTV viewing, is projected as the fastest-growing segment of the media landscape in overall ad spend. Bonus: You can catch lots of great conversations about Walmart’s acquisition of VIZIO.

Going to These Upcoming Conferences? Come Say Hi 👋🏼

ARF AudiencexScience 2024 | March 20-21, NYC

Panel: Rough Waters? Downstream Effects from the Transition to Streaming Via Smart TVs

Hub’s David Tice will be speaking with Justin Fromm, Insights, Samsung Ads.

TVOT SF | March 27-28, San Francisco

Panel: Streaming and Sports

Hub’s

will be presenting findings from the sports study, then moderate a panel discussion.ICYMI Hub in the News:

Sports May Settle the Streaming Wars

“Sports content will have a big impact on the next stage of the streaming wars, and might entirely settle them. There are lots of sports fans, and they care more about the sports they follow than anything else on TV. As expensive as rights have become, they may turn out to be the best investment: hours and hours of unique content which comes with a built-in audience that tunes in every season without fail.” -

, principal at Hub.Leveraging Hub’s recent study, “What’s the Score: The Evolution of Sports Media,” here are 5 takes on what the data is telling us:

NextTV: Hub Study Says Sports May Settle the Streaming Wars

The Streamable: If 75% of Sports Fans Would Follow Their Favorite Sport to Streaming if It Left TV, Why Are Games Still on Broadcast, Cable?

BNN Breaking: The Shifting Sands of Entertainment: How Sports and Streaming Redefine Viewer Engagement

Media Play News: Sports Big Influence in Viewers’ Platform Choice

Newscast Studio: Sports content influencing streaming subscriptions

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s quarterly webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com