The Kid Stays in the Picture—But the Sub Might Not

Families with kids once guaranteed loyalty. In 2025, it’s complicated.

Hub Intel: Deep Dive reports are released monthly, delivering exclusive insights and in-depth analysis on key industry topics—available exclusively to paid subscribers. Paid subscribers also get access to a full premium report for download. Not a paid subscriber yet? Now’s the perfect time to upgrade! For just $5/month or $60/year, you'll receive expert-driven reports packed with exclusive data—plus full permission to cite, republish, and use the insights in your work.

Hub Intel Deep Dive: The Kid Stays in the Picture—But the Sub Might Not

It’s been gospel for decades in the TV business that kids and family programming is essential in driving subscriber growth and retention. In the not-so-long-ago days before rampant cord-cutting, the reasoning of cable, satellite, and telco providers was that kids’ networks like Nickelodeon, Cartoon Network, and Disney Channel were absolutely essential offerings.

While only about a third of homes included kids, those that did watched a lot of kids programming and were intensely loyal to it. The concern was that dropping a kids’ network would be a deal-breaker for many families who subscribed to cable.

But in 2025, is that still true? Are Millennial and Gen Z parents more savvy about curating their TV subscriptions than their predecessors were? Does the relative ease of canceling services today lead to a different loyalty dynamic than in the heyday of cable?

To answer this question, we took a look at three Hub studies — the continuously fielded TV Churn Tracker, the 1Q 2025 The Best Bundle, and the 4Q 2024 Conquering Content.

Is it true that parents and kids are still the holy grail of subscriber loyalty for MVPDs, SVODs, FASTs, and other video providers?

Here are five things to know about families with kids — and how they use TV:

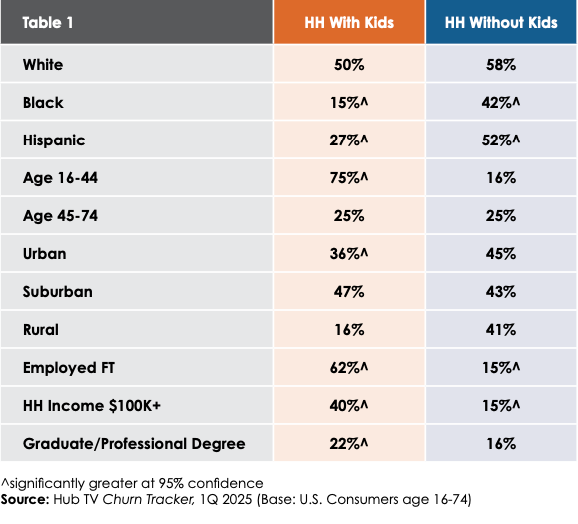

1. They are younger, more diverse, and more upscale.

Of course, families with kids tend to be younger than those without. But it’s important to note that three-quarters of these viewers with kids are Millennial or Gen Z. That means the vast majority of today’s parents have grown up with the internet—and with the expectation of getting the content they want, when they want it, at an acceptable price. They’ve also grown up expecting that if they don’t get what they want, they can readily cancel.

Today’s families are also demographically more diverse, with four in ten identifying as Black or Hispanic.

And they are an upscale group—significantly more likely to be employed full-time, upper income, and highly educated.

Table 1 displays demographic differences between viewers in households with kids compared to viewers in households without kids.

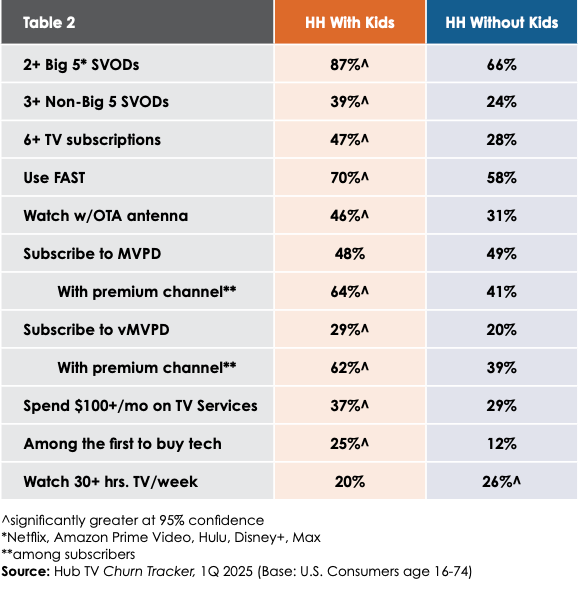

2. They love TV, and they spend on subscriptions (even if they don’t watch as much).

In The Best Bundle study, a solid majority of parents (57%) said TV is “essential” or “very important” to their lives—higher than among people without kids (49%).

And parents put their money where their mouths are. In the TV Churn Tracker, we saw that viewers with kids are bigger spenders, with more than a third spending $100 or more per month on TV.

All that spending translates to higher subscription rates across the board. A whopping 84% of parents have two or more of the Big 5 SVODs (Netflix, Hulu, Disney+, Max, Amazon Prime Video). They’re also substantially more likely to subscribe to premium cable channels if they have an MVPD or vMVPD subscription.

Viewers with kids are also the best customers for video-on-demand and movie purchases or rentals. In The Best Bundle study, 52% of parents rent or buy streaming movies (compared to 25% of non-parents), and 44% use VOD once or more per week (versus only 25% of non-parents).

Even though parents love TV and subscribe to more services, they actually watch less of it—on average, two and a half hours less per week than people without kids.

Parents juggling kids and full-time jobs are likely putting TV on the back burner, even if it remains important to them.

Table 2 displays differences between viewers in households with kids compared to viewers in households without kids on media usage.

Keep reading with a 7-day free trial

Subscribe to Hub Intel: Entertainment Explained to keep reading this post and get 7 days of free access to the full post archives.