For SVODS, It’s Back To The Ad-Supported Future

Why ad-supported streaming is poised to play a bigger role in the video ecosystem.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

For SVODS, It’s Back To The Ad-Supported Future

Recently The New York Times published an article about consumers who are dipping in and out of their video subscriptions titled Americans’ New TV Habit: Subscribe. Watch. Cancel. Repeat. Often when the Times gets around to writing about cultural trends, they’re old news. But in this case, they are on point. Hub has identified the emergence of “serial churners” over the past few years, there is no doubt it has legs, and it’s one of the most daunting issues the streamers are facing as they struggle to reach profitability.

So what’s the path forward for streamers in an ecosystem where roughly 25% of households add or cancel a service in a given month? How do they keep subscribers in the fold longer? One way is by keeping consumer costs down by offering lower-priced ad-supported services. And it’s an option that viewers are increasingly embracing. Welcome to the future of video, which is going to look a lot like its ad-supported past.

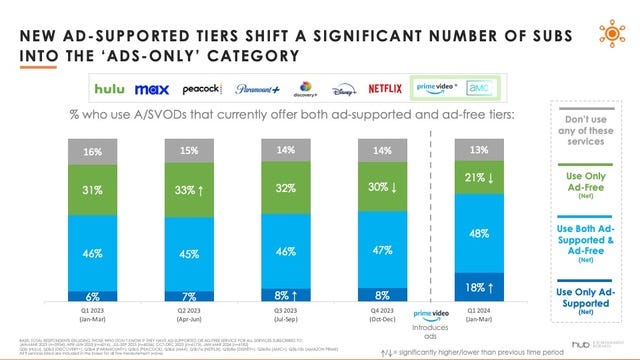

The most recent Hub TV Churn Tracker shows a steady trend of consumers moving away from exclusively watching ad-free streaming, and toward using only ad-supported.

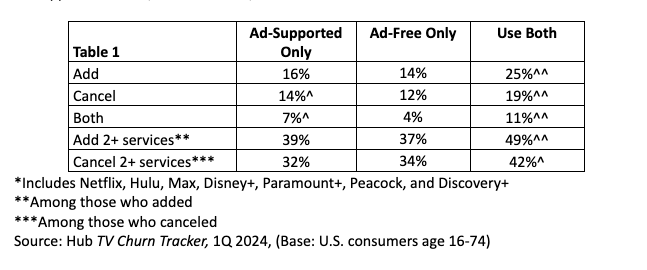

But there’s a rub – viewers who use both ad-free and ad-supported add and cancel services at the highest rate.

The largest segment of viewers, those who watch both ad-supported and ad-free streaming, is significantly more likely to add and cancel services in a given month. Most strikingly, among those who added or canceled, nearly 50% added and 4 in 10 canceled multiple subscriptions. Those are pretty staggering numbers for streaming providers who are fighting for market share.

Table 1 displays differences in adding/canceling TV services among viewers who watch only ad-supported SVODs, ad-free SVODs, and those who watch both.*

As always, content attracts and keeps key subscriber segments.

The folks interviewed by the Times made it clear, and it’s what we see in our surveys. Many viewers add a service to watch something specific, and then cancel when they’re done with it. And consumers in the more upscale viewer groups who use ad-free (48%) and both ad-free and ad-supported (45%) are even more likely than ad-supported only viewers (36%) to cite specific content as their reason for subscribing.

It's the same story for those who cancel a service, with 29% of the “both” group citing a lack of content, compared to 26% among ad-free viewers, and 22% of ad-only viewers.

For most subscribers, it’s a mix of ad-free and ad-supported streaming. But will that change?

Currently the largest group of subscribers to the major streamers are watching a combination of ad-free and ad-supported streaming services, and the smallest segment of viewers watch ad-supported only. Thus far, as the ads only group has grown as the group watching ad-free has shrunk. And there is reason to believe this dynamic will accelerate. As prices rise, more ad-free subscribers are likely to decide it is worth accepting advertising to save on a subscription. Combined with more consumers becoming aware of the lower cost ad-supported options, tier switching should gain momentum among the ad-free viewers.

With Amazon Prime Video migrating its viewers to a default ad-supported tier in February, the group of ad-free only viewers has already declined in the near term. More than 80% of Amazon Prime Video subscribers did not opt into the higher cost no-ads tier and that has had an impact on the entire ecosystem.

Longer term, other services like Netflix and Disney+ have made their intentions clear regarding price increases for their premium ad-free tiers. With all of the Big 5 SVODs (Netflix, Hulu, Disney+, Max, and Amazon Prime Video) now offering lower-cost, ad-supported plans, the number of viewers who watch strictly ad-free content is trending toward being quite small.

A warning for the streamers: don’t overstuff the bird!

Several years ago, Turner exec Kevin Reilly noted that most cable networks had gone too far in adding commercial minutes to their programming, saying, “We have overstuffed the bird.” He was right about linear TV of course. Currently, however, our research shows that in the case of streaming, most services are offering reasonable amounts of advertising in their content.

And as more viewers switch to ad-supported streaming, there will inevitably be a temptation to increase revenue by boosting ad loads. But giving restless subscribers one more reason to cancel by going beyond reasonable ad loads is a bad strategy. For the good of the ecosystem, let’s hope media company executives prioritize holding on to subscribers’ dollars over chasing ad sales nickels.

ICYMI: Hub in the News

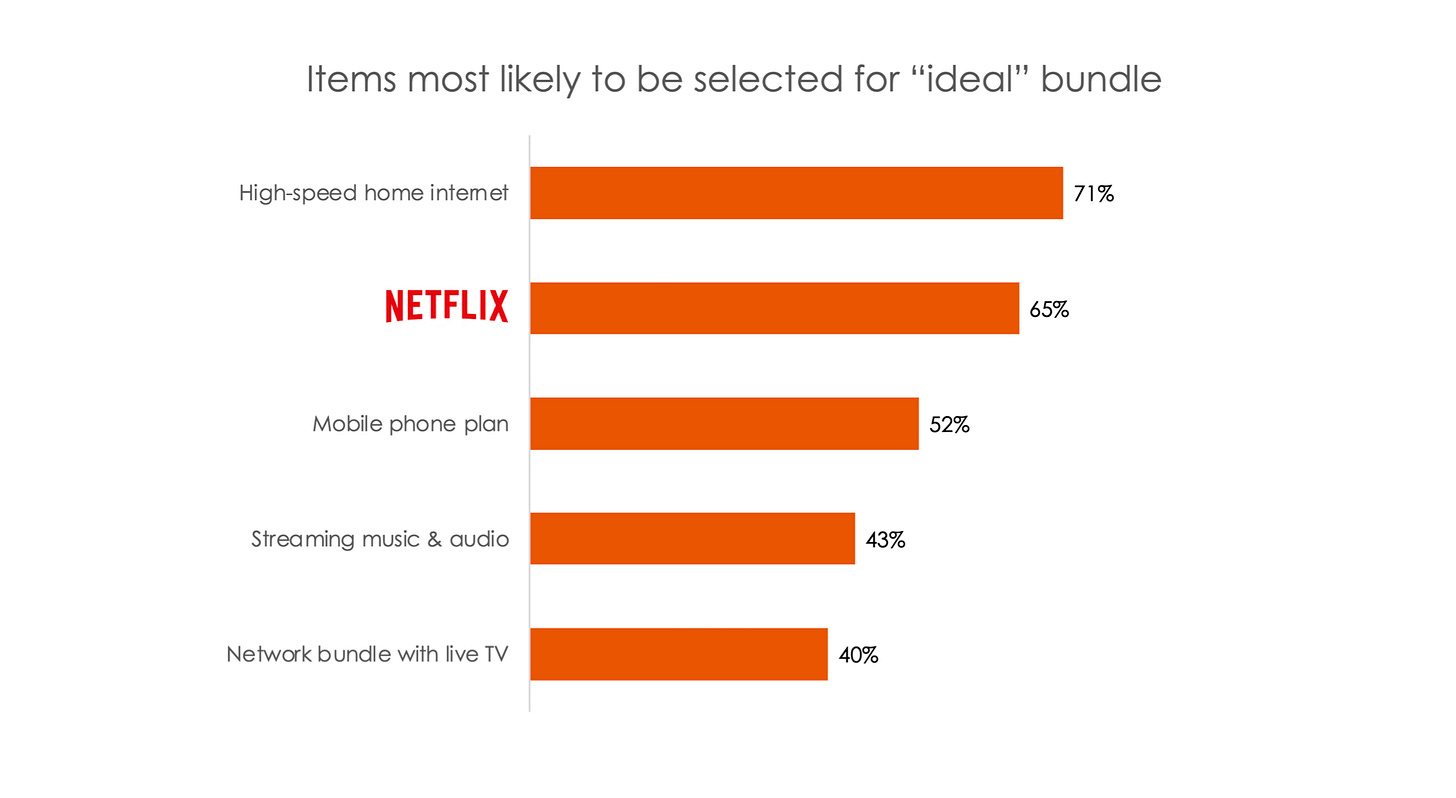

New Research from Hub: Consumers Want a Bundle That Includes More Than Video

“In the past, content like video, gaming, or music were entirely separate. Today, they are all consumed on the same screens and devices, via subscriptions that compete for the same pie of disposable time and money. This research underscores the opportunity for established aggregators like Amazon or AT&T to attract subs with bundles that cross content categories. But it also shows that consumers would readily accept Netflix as an aggregator based entirely on the strength of its brand -- something that bodes well for their expansion into live TV and gaming.” —

, Hub Principal and Founder.Twice a year, Hub’s Battle Royale survey explores consumers’ entertainment choices and behavior across categories: premium video, social video, gaming, music, reading, podcasts, and more. The latest wave of the study revealed new information about consumers’ taste for bundles, and the companies that are best positioned to offer them. Here are 11 takes on the findings.

:STAY: What’s Media’s New Foundation?

Yahoo! Tech: Did Comcast Just Announce Streaming's Stickiest Bundle? These Charts Suggest a 'Yes'

nscreenmedia: Three reasons Netflix should become a super-bundler

VideoNuze: Inside the Stream: Netflix is Well-Positioned to Lead in Bundling and CTV Ads

Media Play News: Hub Research: Netflix Figures Into Consumers’ ‘Ideal’ Bundle

World Screen: Hub: Consumers Want More Than Video In Bundles

TV Technology: If Bundling Is Back, What’s the Ideal Bundle?

Cynopsis: Streaming sports joint venture gets a name

The Streamable: Which Streaming Service Is the Most In-Demand Bundling Option?

Advanced Television: Survey: Consumers want bundles with more than just video

Next TV: Did Comcast Just Announce Streaming's Stickiest Bundle? These Charts Suggest a 'Yes'

Newscast Studio: Netflix and Amazon lead as preferred providers for entertainment bundles

Going to SUBSummit? Come Say Hi 👋🏼

SubSummit | June 17-19, Dallas, TX

Hub’s Jason Platt Zolov will be moderating two panels.

The Streaming Evolution | Tuesday, June 18th from 9 am - 9:30 am CT

As the subscription landscape undergoes significant transformations, none have felt the impact more profoundly than the streaming sector. From navigating brand exclusivity challenges in content, to platform evolution, to coping with market fragmentation and viewer discovery fatigue, maintaining a competitive edge is no small feat.

Streaming Ad Strategy Deep Dive | Tuesday, June 18th from 9:35 am - 10:10 am CT

Discover the keys to success in the streaming industry: personalization and segmentation. In a landscape where tailored content and advertising reign supreme, providers who offer personalized ads emerge as winners, benefiting merchants, advertisers, and viewers alike. Join our panel as we explore cutting-edge technologies driving ad streaming, along with crucial data and analytics insights that empower these growth leaders.

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com