Fact vs. Fiction: How Amazon Prime Video Subscribers Really Feel About Ads

Will viewers spurn the ad-supported Amazon Prime or will it be a love match? Plus, what you missed at TCA.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

The "tornado" has touched down in the advertising marketplace. As of this month, Amazon Prime Video has a new ad-supported video tier, and any viewer who wants to preserve the ad-free experience is going to have to pony up an extra $2.99 per month for a premium service. According to Amazon CFO Brian Olsavsky, execs "feel good” about the move, calling it “an important part of the total business model.” The question is, will viewers spurn the ad-supported Amazon Prime, or will it be a love match?

Ads…what ads?

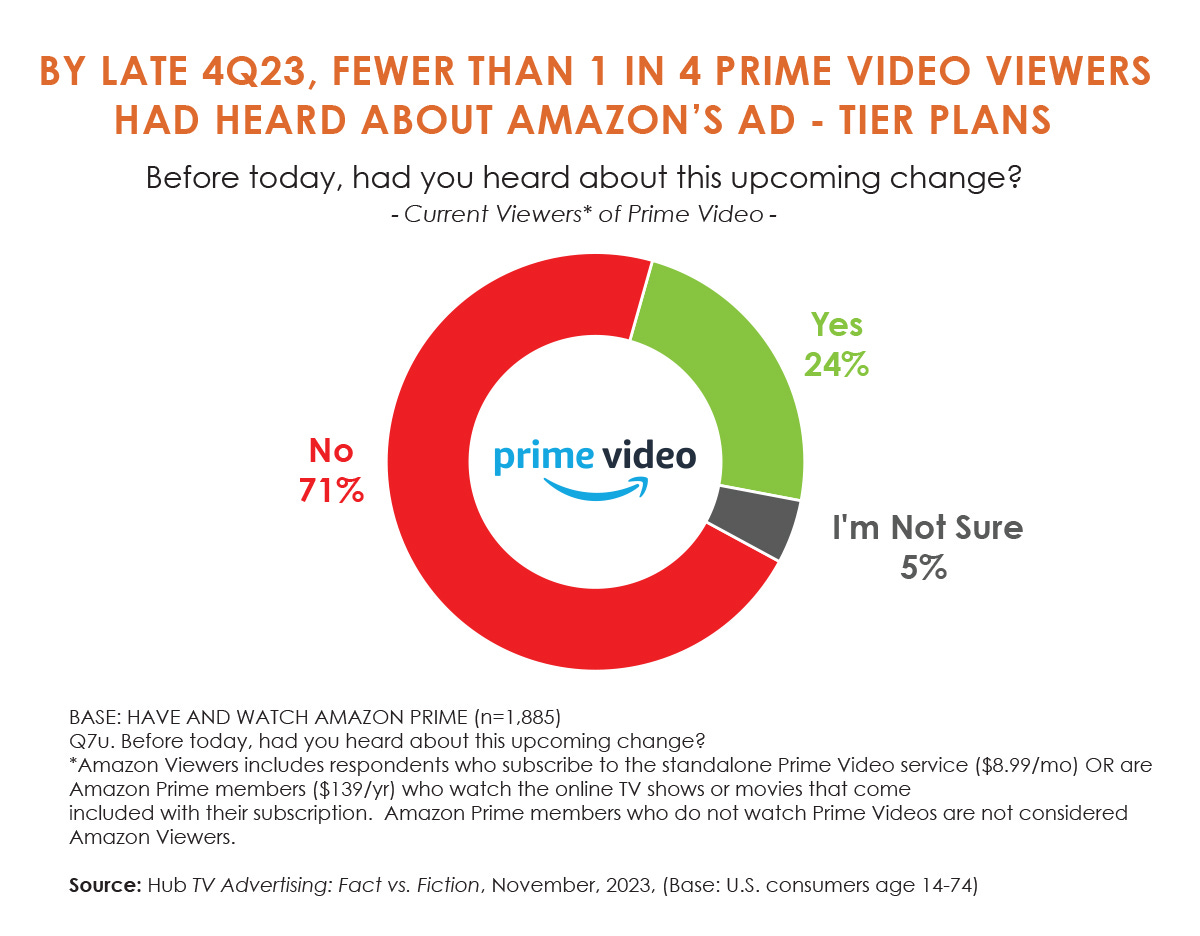

Even though only 25% of Prime Video Viewers knew that ads were on the way as of our survey in late Q423, we have a pretty good idea about how this relationship is going to play out. Hub’s most recent TV Ads: Fact vs. Fiction study confirmed what industry experts have been predicting – most Amazon subscribers will opt for ads instead of paying extra for ad-free.

But don’t people hate watching ads?

A couple of decades ago Artie Bulgrin of ESPN and I did some seminal research on DVR usage. In our work, we found that ad avoidance was a low priority for consumers who acquired DVRs. But we literally had TV execs telling us that our findings were “nonsense” because “people hate ads” and would do anything to avoid them. As it turns out, it was more likely the TV executives who hated watching ads in their programs, not the consumers.

But in the year 2024, the people have spoken – they don’t “hate” advertising, and if opting to watch it saves them money, they might even “love” it. Amazon Prime’s new ad tier is just more evidence that the future of video will look a lot like the ad-supported cable past. And if a segment of consumers will opt to pay more to avoid the ads, it’s a win-win for Amazon.

The subs who do plan to pay for ad-free are the most committed to streaming on Amazon Prime. They are the most likely to have subscribed wholly (10%) or partly (28%) for the video service itself.

What about that 15% percent?

About the 15% who say they will stop watching altogether…maybe they will, but maybe they won’t. Time will tell. But it’s hard to imagine someone who has been committed to Reacher or other Amazon originals refusing to come back for a new season because of ads.

Of note though, the group who will stop watching is significantly less inclined to say they are “very likely” to still be a Prime subscriber in three months (67%, compared to 84% for the other two groups respectively). But it seems doubtful they will bail on the other benefits of Prime membership (like two-day shipping) because the videos have ads. Unlike other streamers introducing advertising, Amazon has little to worry about provoking significant subscriber cancellations.

What does this mean for the video advertising marketplace?

At launch, Amazon Prime Video will immediately have scale. Estimates already put Amazon Prime first in subscribers among U.S. video services. Our research tells us nearly six in ten of Amazon’s base of subs will accept advertising, likely jumping it ahead of the ad-supported versions of Netflix, Max, Disney+, Peacock, and Paramount+, and possibly reaching parity with Hulu. That’s big. Choose your metaphor – tornado, earthquake, sea change – any will be apropos of what’s bearing down on the advertising ecosystem.

Hub Intel’s take: Great news for Amazon, bad news for linear TV and smaller cable groups

Combine mass reach with a deep well of viewer data and a shoppable ad platform directing viewers to the Amazon marketplace, and you’ve got a dominant platform for many advertiser categories seeking reach and a frictionless path to purchase.

It’s hard to see Amazon’s ad offering as anything but bad news for already challenged linear TV ad budgets. That goes double for smaller cable groups that aren’t bundled with robust streaming services like Hulu, Peacock, or Paramount+ (I’m looking at you AMC and A&E).

You can count on combinations of acquisitions, mergers and/or joint ventures as the smaller fish in the video advertising pond try to join forces to protect their budgets from being swallowed by Amazon’s whale of an ad sales team.

In a few years, we may look back on February 2024 as the inflection point that determined how video services are offered to consumers. The fits and starts of competing partners bundling their services may now gather momentum in the face of Amazon’s entry into the advertising arena.

Mark the calendar.

3 Key Takeaways From TCA

Last week Hub’s own

and Mark Loughney spoke about the long tail of peak TV at the TCA Winter Press Tour, where TV critics interviewed casts and showrunners from new shows being released by Apple TV+, AMC, Hallmark, and more. Jon and Mark provided an overview of why reviews matter so much in a crowded TV landscape. Here are a few key takeaways:TV has never been more compelling.

76% say that more of their TV time is spent watching shows they really like today than in the past.

75% say they keep track of new shows and when they are coming out.

41% have signed up for a new subscription just to watch one particular show.

All that compelling content creates a very real paradox of choice.

Today the average viewer watches from almost twice as many sources as they did in 2019.

54% say, “There are so many shows to choose from, I don’t know where to begin.” (We get it.)

Only 10% say algorithmic platform recommendations consistently send them shows they like.

On top of that, viewers are pickier than ever.

Many viewers won’t try a new show unless they’re sure they’re going to like it.

More than half “usually” or “always” need to see a trailer before they decide to watch.

59% are more likely to watch shows with good reviews or awards.

* Source: Hub 2023 “Conquering Content” Study

Join the Hub Team Next Week for a Free Virtual Event

Join us next week for Streaming Media Connect, a free virtual event:

Monday, Feb 19:

joins a panel of analysts to discuss ’s take on Q4 earnings calls, what the numbers tell us, and how we can expect premium streaming, OTT, and the M&E landscape to evolve in 2024.Tuesday, Feb 20: Mark Loughney will discuss targeting, measuring, and scaling connected TV advertising - how opportunities are evolving, types of programming proven to be more effective, and how these factors contribute to the overall landscape of CTV.

Interested? Register here.

Poll: What Topics Should We Cover?

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s quarterly webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com