Hub Intel: Deep Dive reports are released monthly, delivering exclusive insights and in-depth analysis on key industry topics—available exclusively to paid subscribers. Paid subscribers also get access to a full premium report for download. Not a paid subscriber yet? Now’s the perfect time to upgrade! For just $5/month or $60/year, you'll receive expert-driven reports packed with exclusive data—plus full permission to cite, republish, and use the insights in your work.

Netflix and Chill…With Ads

As the third anniversary of Netflix’s Standard With Ads tier approaches, it’s an opportune moment to take stock of where it stands in the video ecosystem. One thing is certain: according to Hub’s TV Churn Tracker, the ad-supported plan has been an unqualified hit with viewers.

In our latest Q2 report, 42% of Netflix subscribers say they have Standard With Ads — triple the proportion from just two years ago.

Other sources are reporting similar trends. In 2024, twice as many new Netflix subs opted for ads compared with 2022.

At times like this, it can be informative to look back at our hot takes on Netflix Standard With Ads in early and mid-2023 according to a Hub report.

In January 2023, we were cautiously optimistic as we noted:

Netflix Standard With Ads is intended to grow the subscriber base by attracting non-subs. But results so far don’t provide solid evidence that growth will be sufficient to offset revenue lost from existing subs trading down.

We also pointed out reasons to think the “trade-down” effect might be limited, given Netflix’s early reporting that Standard With Ads uptake was modest.

By July 2023, the picture was shifting. Both Disney+ and Netflix were seeing success with their ad-supported offerings. As we put it then:

Even if Disney+ and Netflix didn’t launch home runs with their ad tiers, they’ve been solid hits. In a market where just keeping subs is tough, Netflix added to its North American base, while Disney grew revenue without sparking subscriber backlash. Count both as wins.

Two years later, we can say it confidently: Standard With Ads has been a victory for Netflix.

So, let’s dive deeper into Hub’s TV Churn Tracker and TV Advertising: Fact vs. Fiction to profile Netflix’s ad-supported audience — and see how they differ from their ad-free counterparts. Below are eight findings worth noting.

Who Are Netflix’s Standard With Ads Subscribers?

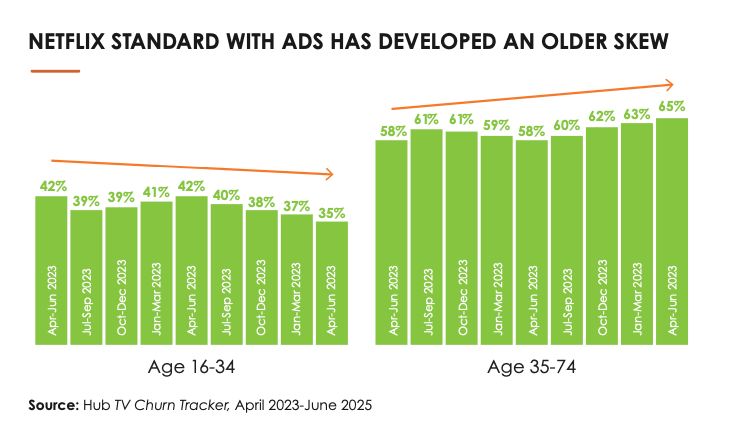

1. They are skewing a bit older.

Currently, two-thirds of Netflix Standard With Ads subscribers are age 35+. That older skew has accelerated over the past year.

2. They’re less upscale than ad-free subscribers.

In an entirely predictable finding, Netflix ad-free subscribers have significantly higher incomes than other TV viewers, and particularly, are more upscale than Netflix Standard With Ads subs. Notably, 39% of Netflix ad-free subscribers earn over $100K — compared to just 28% of those on the ad-supported tier.

3. They’re increasingly more likely to be cord-cutters and cord-nevers.

In May 2023, 28% of Netflix Standard With Ads subscribers lacked an MVPD or vMVPD subscription; by May 2025, that number rose to 34%. With their lower-income profile, many seem to be treating the ad-supported tier as a substitute for costlier multichannel services.

Keep reading with a 7-day free trial

Subscribe to Hub Intel: Entertainment Explained to keep reading this post and get 7 days of free access to the full post archives.