What Has a Screen, Runs Apps, and Becomes Obsolete After Just a Few Years?

Time to Add Smart TVs to the List!

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

A press release from LG during this year’s CES conference didn’t garner a lot of attention, but it said a lot. LG used the release to crow about its free OS (operating system) upgrades for some of its “older” models – “older” meaning 2022 or newer. This announcement emphasizes that the ownership of TV sets in our new age of Smart TVs is going to be different from what consumers have experienced in the past.

The Smart TV product purchase cycle is shaping up to resemble that of Smartphones. In the past, when people owned either analog sets or pre-smart digital sets, consumers would often keep TV sets for 10 or more years; as long as the picture and sound were still good, they were usable. It even made sense to fix broken TV sets!

Today’s Smart TVs consist of more dynamic, developing technology. Advances in hardware, OS, and apps require devices to be replaced every few years, as seen with smartphones, tablets, or laptops. Just like with those other digital devices, as Smart TVs age, at some point support for the OS and app software will end. Their pictures and sound may continue to be excellent, but they will lose the ability to stream using their built-in capabilities.

Why is This Important?

Because, according to Hub’s 2024 Connected Home report, almost all (88%) of current owners use their Smart TV’s built-in streaming capability. This reliance on using Smart TVs to stream means when obsolescence hits – at least in terms of running up-to-date OS and apps – these TVs turn into high-definition monitors, forcing consumers to either replace the Smart TV altogether or find an alternative way to stream to its screen.

Is This Good or Bad?

It’s not either, really. It’s just a different mindset for consumers, and needs to be on the radar of everyone in the TV/streaming ecosystem.

For consumers, it means a TV set is unlikely to last as an integrated streaming unit for the 10 to 15 years they may have been used to analog sets lasting. They may need to get a new set every 5 to 10 years; especially for older consumers, this may seem wasteful. But is this really such a hardship when people are already conditioned to getting new Smartphones every 3 to 5 years… especially when new smartphones are often much more expensive than Smart TVs? (At a popular electronics store on April 18 2024, a new iPhone 15 (256GB) is $929; a new, not-on-sale 65” 4K smart TV from LG is just $529.)

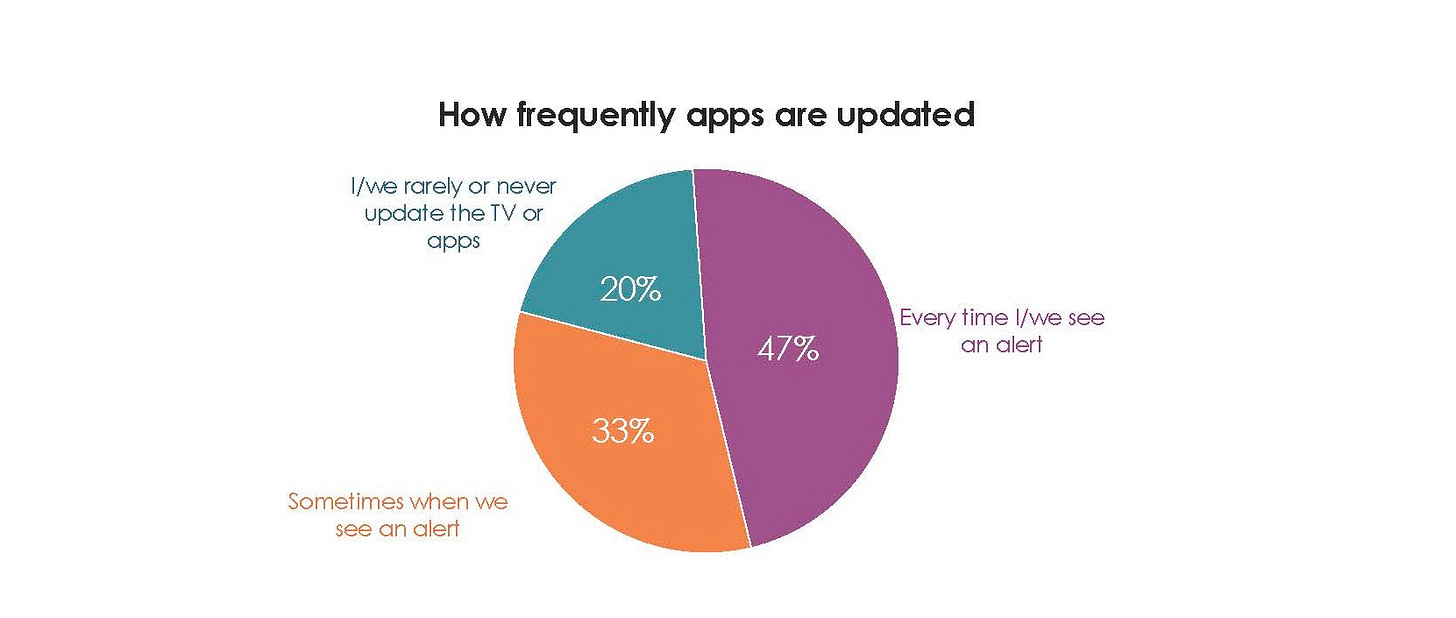

Consumers also need to get used to updating their sets as often as they do their Smartphones. They are getting pretty good at it – at least with their most-used set. In 2023, Hub’s Evolution of the TV Set report found 4 out of 5 Smart TV owners update their OS or apps at least sometimes when prompted – but a sizable 20% never do.

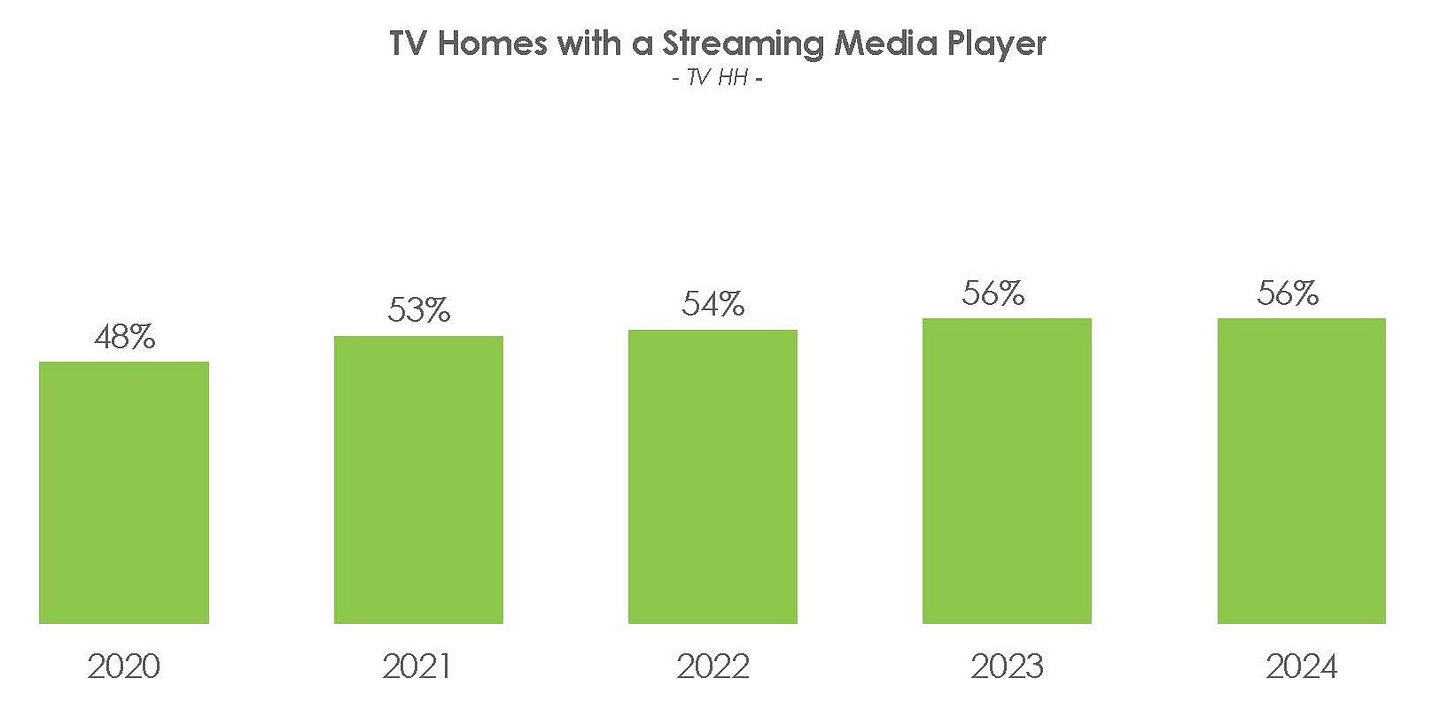

Consumers also have the option of bringing an obsolete Smart TV back to life by connecting it to an inexpensive streaming media player, like a Roku or Fire TV. I speak from experience, with two older Smart TVs in my own home operating like this. Contrary to some who believe “dongles are dead,” I believe streaming media players still have a long life as devices to keep older Smart TVs from the tech recycling pile. Hub’s 2024 Connected Home report confirms my hunch. We see this in the persistence of ownership of these devices, even as they were bypassed by streaming on Smart TVs.

What Else Should We Consider?

Manufacturers have an opportunity to make up for today’s commodity pricing for TVs by exploiting a quickened replacement cycle, or by offering ways to upgrade their own – or competitors’ sets – with connected devices. Also to be considered is how viable is a proprietary OS in the face of widely licensed OS like Roku, Fire, or Google TV?

Content distributors/platforms have already been making choices about which brands and models to support with their apps. Since every OS version may need a tweaked app, which is worth the IT investment? This seeming myriad of choices will only get bigger, with important decisions having to be made about which OSs are worth doing business with.

Advertising sellers and buyers also face the multiple-platform issue. How do they ensure interactive ads operate across a multitude of combinations of brands, models, and app versions? How is audience or ad performance measurement accomplished across the spread of options?

The transition of the TV set from a dumb appliance to a Smart one akin to a Smartphone is not necessarily a good thing or a bad thing – but it is a thing. This shift is not only altering the habits of television owners, but it also warrants consideration by all stakeholders in the TV value chain as to the impact on their strategies.

David Tice is a 30-year veteran of the media research space, specializing in tracking the adoption of new TV and TV-related technology as well as the impact of new technology on audience behaviors. He is a senior consultant emeritus for Hub Entertainment Research.

ICYMI: Hub in the News

Hub’s Latest TV Churn Tracker Shows Amazon Prime Video Has More Consumers Shifting to Ad-Supported Streaming

“Virtually overnight, Amazon Prime Video dramatically transformed the video advertising ecosystem. Suddenly advertisers have the ability to reach tens of millions of viewers on one platform, with robust targeting capabilities and a vast retail capability. Amazon has immediately launched themselves into ‘must buy’ territory for advertisers and media agencies.” —

, Senior Consultant at HubLeveraging Hub Entertainment Research’s Q1 TV Churn Tracker, here are 8 takes on how Amazon Prime Video’s ad-supported tier has shaken up the streaming advertising ecosystem.

The Streamable: Amount of Streaming Customers Using Ad-Supported Plans Jumps 10% After Prime Video’s Ad Rollout

Media Play News: Hub: Prime Video Has More Subs Shifting to Ad-Supported Streaming

TV Technology: Survey: Amazon’s Push into Ad-Supported Streaming Is Working

Next TV: 85% of Amazon Prime Video Subscribers Are on the Ad-Supported Tier

World Screen: Hub Research: U.S. Streamers Are Shifting To Ad-Supported Tiers

Newscast Studio: No backlash from Amazon Prime Video’s ad-supported move, Hub survey notes

VideoNuze: Inside the Stream: Amazon Cranks Up Ad-Tier Subscribers; Disney’s DTC Progress

nscreenmedia: nScreenNoise – It’s Tubi time for many; Prime Video ads redux

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com