Ad-Verse Reactions, Valuable Results

A deep dive into the ad-haters who just might be your best audience.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Ad-Verse Reactions, Valuable Results

For more than three years, Hub has been tracking one unequivocal finding in our semi-annual TV Advertising: Fact vs. Fiction study: most viewers are perfectly willing to accept advertising—if it saves them money on video subscriptions. And over time, the minority who claim they can’t tolerate ads has been shrinking.

In other words, even as more platforms adopt ad-supported models, viewer tolerance for ads is actually going up.

Here’s the kicker: the group driving this shift isn’t the ad lovers—it’s the ad intolerants.

Back in December 2022, just 26% of viewers who said they couldn’t tolerate ads were open to ad-supported tiers. Today? That number is pushing 40%.

So, who are these self-described ad haters? How are they watching TV, and what do they really think about ads?

Here are five things to know:

1. They’re lighter TV viewers.

Ad-intolerant viewers report watching less TV—just 17.5 hours a week, which is 2.5 hours less than the “content matters most” group, and 1.7 hours less than viewers who say they can tolerate some ads.

This lighter viewing may be tied to the fact that 39% of ad intolerants are 18–34 years old—a significantly younger skew than other groups.

But here’s a twist: while younger viewers are generally more likely to watch FASTs, the ad-intolerants buck that trend. Just 54% say they watch FASTs, compared to 65% of the “content matters most” group and 62% of the ad-tolerant group.

Which makes sense. If you truly hate ads, you’re not hanging out on platforms built around them.

2. They watch both ad-free and ad-supported TV.

Nearly 100% of viewers—ad intolerant or not—consume some ad-supported video. Sports, news, and even SVOD make ad avoidance nearly impossible.

That said, ad-intolerant viewers lean toward ad-free options, which makes them the group most likely to watch both ad-free and ad-supported TV.

Here’s the surprise: nearly one-third of ad intolerants watch only ad-supported TV.

That’s more than the 21% who strongly agree that “the more subscriptions I pay for, the more open I am to new subscriptions that cost less (or are free) but include advertising.”

In a fragmented TV world, even viewers who say they hate ads are embracing AVOD and FAST to save money.

3. They think ad loads are unreasonable—but still pay attention.

No shocker here: ad-intolerant viewers are the most likely to say ad loads are unreasonable and that ad breaks reduce their overall viewing experience (leaving aside a consideration of the content they watched).

But here’s the twist—they’re also just as likely as others to say they pay attention to most or all of the ads and promos they see.

From an advertiser’s perspective, that’s not a bad tradeoff. You might disrupt their experience—but you’ll get their attention.

Because…

4. They rate ads more positively than you’d expect.

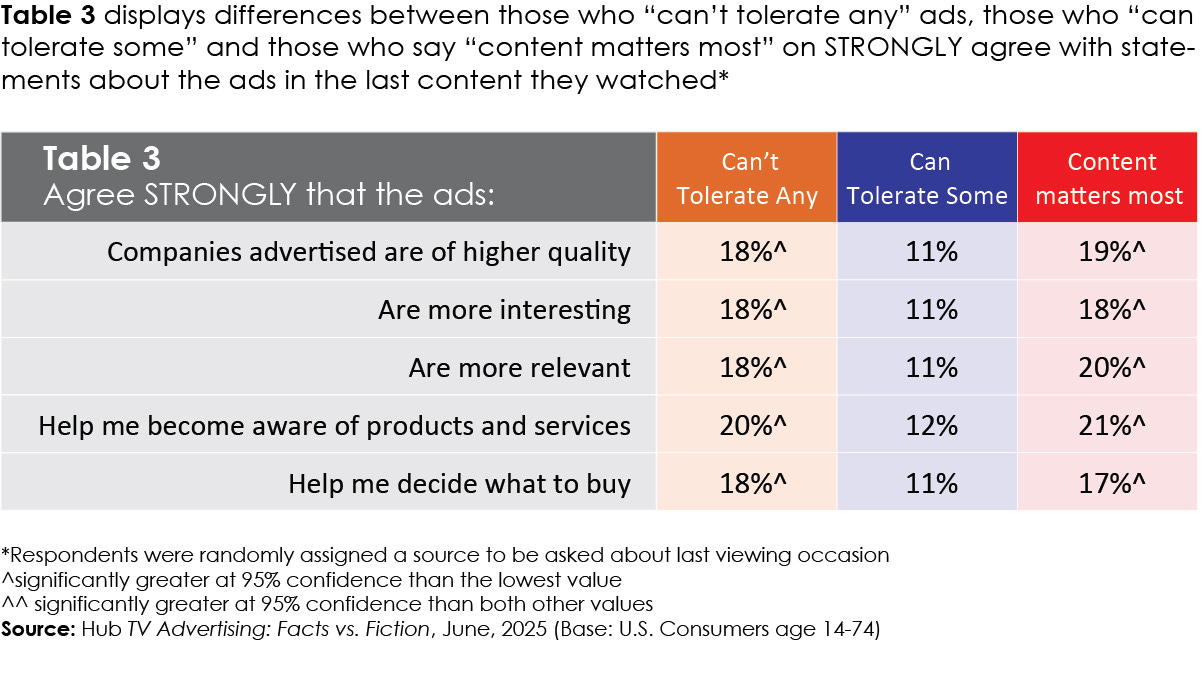

Ad intolerants, along with “content matters most” viewers, give ads higher marks across the board than those who say they can tolerate some ads.

They’re more likely to strongly agree that ads were for high-quality brands, that the ads were interesting, and that they helped them decide what to buy.

So not only are they watching the ads—they find them more useful.

Score one for advertisers.

5. They’re less moved by ad innovations.

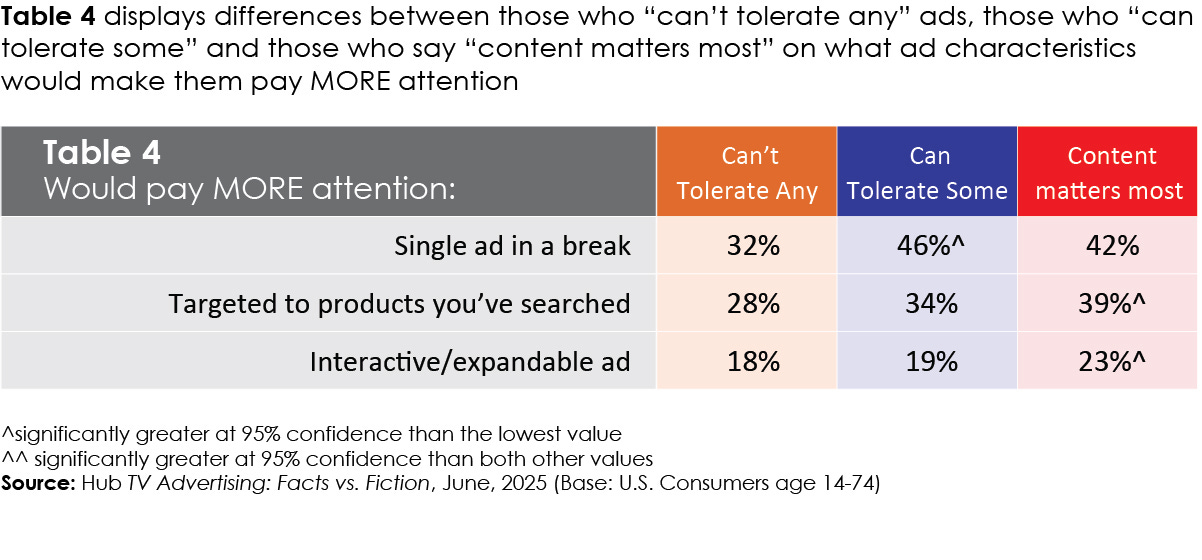

We’ve written plenty about how improving the ad experience—shorter breaks, smarter targeting—boosts viewer satisfaction.

But don’t expect bells and whistles to win over the ad intolerants.

They were less likely than other viewers to say breaks with only one ad, ads targeted to their search history, or interactive/expandable ads would get them to pay more attention.

In fact, several ad break innovations or changes would actually result in the ad intolerants being significantly less likely to pay attention.

Enhancements improving the ad experience are unquestionably a worthy pursuit, given the effect on viewer satisfaction. But providers should recognize those who will pay more attention to such innovations are the viewers who already are most tolerant of advertising.

Shorter ad breaks, shorter ad lengths, and single ads in a break were unappealing to the ad intolerants. Why? It may be that shorter or “better” ad breaks signal more frequent interruptions. And if you already hate ads, that’s not a win.

So what do we do with the ad intolerants?

The bad news: they don’t love TV, and they don’t love advertising.

The good news: they do pay attention—and find ads useful.

They may be the most reluctant participants in the ad economy, but they’re also among the most valuable. They watch fewer hours, but when they do, they’re paying attention—and acting on what they see.

As subscription prices rise, even these self-proclaimed ad haters are opting into ad-supported tiers to save money. That has big implications:

For streamers: Higher subscription fees could push more ad-intolerant viewers toward ad-supported plans. The challenge? Balancing higher per-user revenue from a shrinking base of premium subscribers with potential scale from a growing AVOD audience.

For advertisers: There’s opportunity in this paradox. Ad-intolerant viewers may be harder to please—but they’re paying attention and making decisions. That’s a segment worth reaching.

Going to These Upcoming Conferences? Come Say Hi 👋🏼

StreamTV Show: June 11-13, 2025 (Denver, CO)

Fireside Chat with DirecTV

Thursday, June 12, 12:05pm—12:25pm (MDT)

Debate: Which Measurement Matters Most: Content vs. Advertising

Thursday, June 12, 1:35pm —2:20pm (MDT)

Two teams compete, using National High School Debate Club Rules on what each argues is THE most important measurement metric for the Streaming Era. A thought-provoking discussion between top media researchers —including Hub’s Jon Giegengack —on audience behavior, data-driven content strategies, and the impact of analytics on media consumption. Moderator: Evan Shapiro.

Fireside Chat: Sports Content Distribution: Growth Strategies for the Streaming Era

Friday, June 13, 2025 11:30am—12:00pm (MDT)

As live sports continue to dominate engagement across platforms, streaming services are racing to refine their content distribution strategies. Hub’s Mark Loughney exploring key questions:Linear, Streaming, or Social: Where Is the Real Growth in Sports Content Happening Today?What Role Do Strategic Partnerships Play in Scaling Sports Distribution?And How Do You Build a Scalable Sports Strategy Without Premium Rights?

Panel: Insights in Minutes: What’s Next in Streaming TV?

Friday, June 13, 2025 2:40PM—3:30PM (MDT)

To close out the educational programming, top industry analysts — including Hub’s Mark Loughney — will come together for a fast-paced, insight-driven session that breaks down key trends in the streaming market. In rapid 10-minute intervals, each expert will share their perspectives on the most pressing topics shaping the industry, offering valuable insights into consumer behavior, market dynamics, and what’s next for the industry. This will be followed by a 20-minute interactive panel discussion where the analysts will compare notes, offer predictions, and highlight emerging opportunities in the streaming ecosystem.

TVOT SF 2025: June 25 - 25, 2025 (SanFrancisco, CA)

Panel: AI in Entertainment: Captivating Audiences or Crossing the Line?

Wednesday, June 25th, 2025 3:10pm (PT) — Dining Room

Whether it’s generating content, enhancing the viewer experience, or improving discovery, the capabilities of AI are advancing faster than many expected. But is there a price to pay for the benefits AI could deliver? In this session, Hub Entertainment Research Founder and Principal, Jon Giegengack, will present the latest research on which AI applications consumers are excited about, which they’ll tolerate, and areas they’re uncomfortable with AI being used. Then we’ll discuss the report’s findings with a panel of experts to learn more about where AI can have the biggest and most positive impact in today’s TV ecosystem.

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub research on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies, to gaming, music, podcasts and social video. Working with the largest networks, pay TV operators, streaming providers, and studios, Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com