Will TV Finally Play Fair with Women's Sports?

How should women’s sports be valued in the new TV landscape?

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Will TV Finally Play Fair with Women's Sports?

Despite the fact that women comprise 50.5% of the U.S. population, women’s sports receive a mere 15% of all sports media coverage, as revealed by a 2023 Wasserman study. Women’s sports have gradually gained popularity since the passing of the Title IX in 1972, but to date, television deals for women’s leagues have been underwhelming or nonexistent.

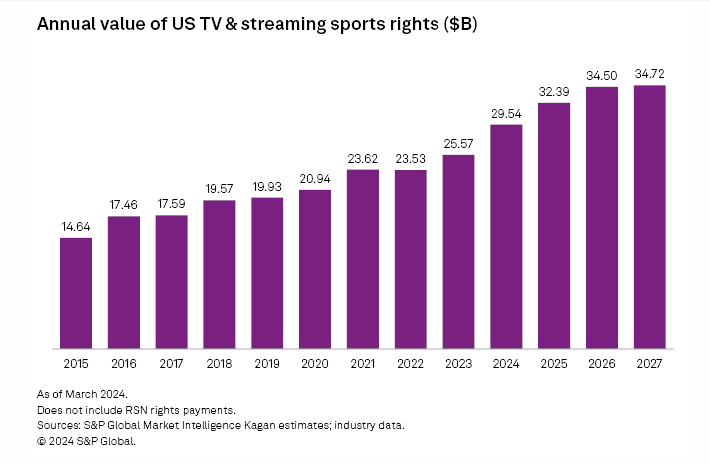

There are signs of change, though. An evolving media landscape and economic pressures have forced both traditional and digital media companies to reevaluate their strategies. In the scramble to shore up audiences, drive subscriptions, and increase engagement, streaming services and traditional media companies have realized that live sports are their safest bet. Broadcast, cable, and streaming demand for live sports is at an all-time high, and record television rights deals are being handed out.

How should women’s sports and leagues be valued in this new landscape?

A common refrain is that women’s sports can’t possibly match the interest or audience deliveries of their male counterparts. This is a self-fulfilling prophecy. Too often, their broadcast partners give these leagues a fraction of the support and visibility that men’s leagues receive, and viewership suffers. When the full resources of a broadcast partner are behind an event or league—meaning favorable viewing windows, pre-and post-game studio shows, athlete profiles, and even discussions of odds—we’ve seen women’s sports deliver mass audiences and drive conversation. Here are just a few examples:

Let’s consider the Olympics, a level playing field for media coverage of men’s and women’s sports. Women’s sports made up 57.55% of NBCU’s primetime broadcast for the Tokyo Olympics. It was this on-air support that made Women’s Gymnastics, Basketball, and Soccer some of the most anticipated and watched events of the games. (We’re eager to see the stats measure up for the Paris Olympics.)

Viewership for the NCAA Women’s Basketball Finals has been building over the past six years. This year, Caitlin Clark became one of the most discussed athletes in the nation and garnered around-the-clock coverage from NCAA broadcast partners ABC and ESPN. The 2024 NCAA Women’s Final, featuring Clark’s Iowa Hawkeyes, attracted 18M viewers, outdrawing the Men’s Final by 4M viewers.

ESPN has made the Women’s College World Series (WCWS) a centerpiece of their spring programming. Viewership for this year’s series-clinching game was 2M, making it the most-watched WCWS game on record.

The 2015 FIFA Women’s World Cup Final (USA vs. Japan) currently stands as the second most-watched soccer match in U.S. history at 26.7M viewers.

Media rights deals are on the rise

With proven viewership potential, media rights deals for the WNBA and the National Women’s Soccer League could set benchmarks for future women's sports league negotiations. The NBA and WNBA recently secured an 11-year, $76 billion media rights deal with Disney, NBCU, and Amazon. Although the league did not reveal the exact value, it is believed the WNBA piece of the deal could be worth as much as $200M a year, more than tripling its current annual payout. In 2023, the National Women’s Soccer League (NWSL) signed a four-year, $240M deal with CBS, ESPN, Prime Video, and Scripps Sports. The new deal is a huge increase over the previous three-year, $4.5M agreement with CBS.

Smaller or lesser-known women’s leagues also present opportunities for those looking to acquire live sports. Unrivaled, a three-on-three women’s basketball league similar to the men’s Big3 league, is currently looking to secure media rights. Smaller leagues like Professional Women’s Hockey League (PWHL) and Women’s Professional Fastpitch (WPF), also deserve the consideration of national broadcast partners. Change will truly be evident when smaller women’s leagues are given the opportunities and exposure afforded to men’s sports like the Premiere Lacrosse League on ESPN and Big3 Basketball on CBS.

Stereotypes and bias have prevented women’s athletics from reaching their due place in entertainment. Media companies rarely act for altruistic reasons, so here’s my pitch: Do not elevate women’s sports because it is the right thing to do (although it is); do it because it might just make money! The audience is there, the interest is growing, and the financial incentives are becoming increasingly apparent. It's time for media companies to get it right and give women’s sports the spotlight they deserve.

Chip Walters is a media strategy analysis and communication leader and with more than 20 years of experience supporting premier entertainment studios and broadcast/cable networks. He is known for his ability to synthesize and communicate complex data to internal and external stakeholders. Chip was most recently SVP of Research for The CW Television Network.

ICYMI: Hub in the News

Fact vs. Fiction Research Shows Viewers Are Positive Toward the Streaming Video Ad Experience

“Over the past few years, the video ecosystem has seen fundamental change, with nearly all of the formerly ad-free streamers adding a lower cost ad-supported tier. Consumers have responded not by rejecting advertising or canceling subscriptions, but embracing the opportunity to save on their monthly subscriptions. By putting forth an overt offer of lower fees in exchange for watching a reasonable number of ads, the streaming services have given consumers a better value proposition. As a result, the future of the streaming advertising marketplace looks very bright.” —

, Hub Senior ConsultantAn increasing number of TV viewers are accepting advertising in streaming video and they are readily able to discern the differences in how various services deliver the ad experience. Leveraging Hub’s latest wave of its semi-annual TV Advertising: Fact vs. Fiction survey, here are 7 takes on the latest research.

Forbes: After Years Of Avoiding Ads, Viewers Suddenly Don’t Mind Them As Much

MediaPost: Premium Streamers Provide Best 'Ad Experience,' MVPDs Have The Worst: Study

Senal News: USA: 66% SVOD Users Prefer Cheaper Ad-Supported Plans

Advanced Television: Survey: Viewers positive on streaming ad experience

The Streamable: Tolerance for Streaming Ads Grows Markedly as Viewers Try to Control Costs

Media Play News: Hub: Viewers Positive Toward Streaming Video Ads

TheDesk.net: Survey: Streamers open to ads if it saves them cash on subscriptions

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com