Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Bundles Are Back, Baby!

The streaming wars aren’t over, but they’re a lot more congenial these days. Platforms once committed to an “all or nothing” battle to beat Netflix are now once again licensing their exclusives to Big Red. Streaming rivals like WBD and Disney are banding together voluntarily to attract and keep more subscribers. And cable companies – the original TV bundlers – are offering bundles of the same streaming platforms they once considered an existential threat.

With lots of individual programmers grouped into bundles that cost less but also make you pay for some channels you don’t really want, it’s not hard to see why some are calling this “cable 2.0.” But the transformation underway is more profound: the next generation of bundles will change more than just TV and enable more companies to benefit from the shift to streaming.

Let’s look at some of the most interesting findings from the Battle Royale, Hub’s biannual study on bundling:

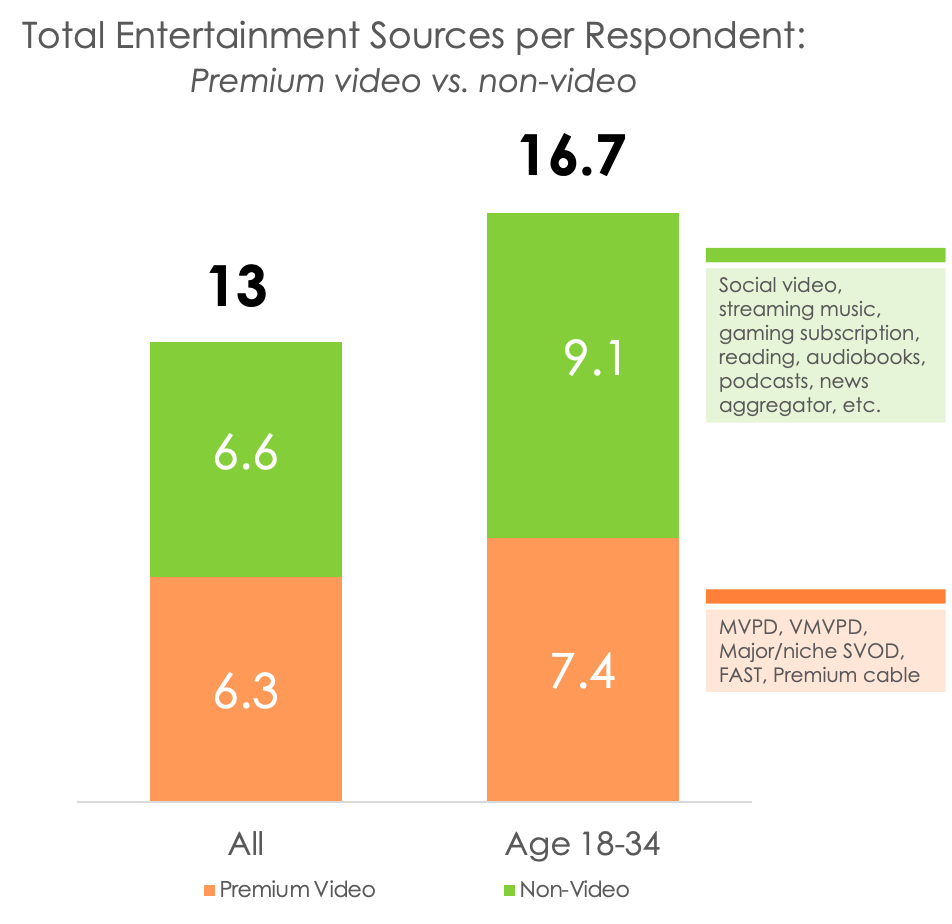

Consumers have subscription fatigue. Across all categories - premium video, social video, gaming, music, podcasts, digital reading – the average consumer uses 13 different sources of entertainment. With all those sources, simplicity is a virtue that many are willing to pay for. A whopping 59% of respondents said they would pay for an app or service that let them manage and use all their subscriptions in one place – even if that service didn’t include any content of its own.

TV is no longer the center of the entertainment universe. It’s just one star in a whole constellation of content. Of those 13 sources, only about 50% are premium video. And among young people, premium video sources make up less than 50% of their entertainment ecosystem.

The “most wanted” bundles go beyond video – and even beyond entertainment. In our April survey, respondents completed a “build your own bundle” exercise to find out which content and services they would combine if given the chance. First, we showed consumers a list of 16 potential bundle “ingredients” – everything from streaming subscriptions to high-speed internet to news aggregators, and even hardware subscriptions (like a game console or smart TV). Then we asked them to choose any 5 of those 16 to build their “ideal” bundle. Their choices ran the gamut of content and providers. Here’s what we discovered:

71% included high-speed internet in their bundle. It was the most-requested ingredient of all 16 items.

65% included Netflix. It was the only SVOD subscription to appear in the top 5.

An MVPD/vMVPD network bundle with live TV made the top 5 (40%) – but more people chose mobile phone service (52%) or a streaming music subscription (43%).

So, what are the opportunities here? There are at least 2 big ones.

Opportunity #1: Build or join bundles that cross content categories. The original cable “triple play” found success by simplifying TV, internet, and home phone. Today’s consumers have far more subscriptions, so the opportunity to simplify is more attractive than ever. And bundles that simplify their subscriptions across different kinds of content are more compelling than those that only include streaming platforms.

For example: everyone knows Amazon Prime members get access to Prime Video. But they also get access to Prime Gaming (a library of video games to download or stream) and a free tier of Amazon Music. In our survey, respondents rated every subscription they use as either “must-have” (“something my household can’t do without”) or “nice to have” (“I might miss it, but can do without”). Prime members who used gaming and/or music content as well as video were far more likely to say Prime entertainment content was a “must have.” In a world where stopping churn is job #1, that’s a tool too powerful to pass up.

Opportunity #2: Build bundles tailored to specific audiences. Bundles don’t need to be one-size-fits-all. On the contrary, there's a huge opportunity for bundles to meet the needs of a specific group. For instance, let’s look at the “build your own bundle” results for Gen Z men:

Like consumers in general, they’re most likely to bundle Netflix, internet, music, and phone. But nearly half (44%) included a gaming subscription in their bundle. For Gen Z men, gaming was more important than Hulu (40%), Disney+ (35%), or Max (26%).

Close to a third included a game console lease/subscription (31%) vs. a fifth who selected an MVPD/vMVPD live TV package (21%).

A “gamer bundle” marketed to this group would be valuable, but it would also be distinctive – something the many bundles based on streaming video are not.

What’s next in bundling?

Amazon has bundled both music and gaming with Prime membership since 2016. Disney’s $1.5 billion stake in Epic Games and Netflix’s growing investment in mobile and cloud gaming signal plans to engage consumers with new kinds of content.

Media companies that aren’t thinking this way need to start because the resurgence of bundles isn’t a reversion to the old cable model. It’s yet another evolution in how people will consume all kinds of content in the future. It’s also a big opportunity for traditional aggregators (like cable operators) and for companies that own IP that can be extended across categories. The next stage of bundling will give all providers more tools to attract new subscribers, but also keep them around.

ICYMI: Hub in the News

What Viewers Want (excerpt from Emmy Magazine)

When it comes to figuring out what viewers want, networks and streamers turn to firms like Hub Entertainment Research. , founder and principal of the Portsmouth, New Hampshire-based firm, says with so much content available, many viewers rely on critics or award nominations for ideas on what to watch.

“Viewers like shows or universes that are familiar,” he adds, citing the Star Wars shows on Disney+ and the Yellowstone spinoffs on Paramount+.

Hub, founded in 2013, conducts about 75,000 studies per year, serving all the major networks, streamers, cable and satellite companies. Each survey has 2,000-5,000 respondents, consisting of U.S. TV viewers aged 13-74 who have high-speed internet and can stream TV.

The average viewer, Giegengack notes, subscribes to three or four streamers, and 40% say they started a new subscription just to watch one show. About the same number say they’ve canceled a service in the past six months, usually because they ran out of things to watch.

Going to These Upcoming Conferences? Come Say Hi 👋🏼

SubSummit | June 17-19, Dallas, TX

Hub’s Jason Platt Zolov will be moderating two panels and presenting.

The Streaming Evolution | Tuesday, June 18th from 9 am - 9:30 am CT

Streaming Ad Strategy Deep Dive | Tuesday, June 18th from 9:35 am - 10:10 am CT

The Subscription Prescription: How to Build a Stickier Streaming Service \Wednesday, June 19th | 10:30am - 11am CT

StreamTV Show | June 24-26, Denver, CO

Hub’s

will be speaking and moderating a panel.Optimizing Subscriber Revenue: Bundling Strategies, Pricing Models, and the World Beyond Advertising | Tuesday, June 25 | 1:30pm - 2:10pm

Analysts Lightning Panel: Unveiling Trends, Behaviors, and Metrics in Streaming | Wednesday, June 26 | 3:00-3:45pm

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com