Anime-ation Nation

How Gen Z’s love of anime and international content is changing the rules of streaming.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Anime-ation Nation

In the streaming wars of 2025, where every platform is battling for attention, the real battleground isn’t just for eyeballs—it’s for the hearts and wallets of the next generation of consumers. And for Gen Z, increasingly, that battle comes with subtitles.

While legacy media scrambles—or worse, ignores—Gen Z's viewing habits, the data is clear: anime and international content aren’t just passing trends. They’re baked into Gen Z’s entertainment DNA.

To win Gen Z, here are six things that streamers need to understand:

1. Gen Z is choosing anime over America’s favorite pastimes.

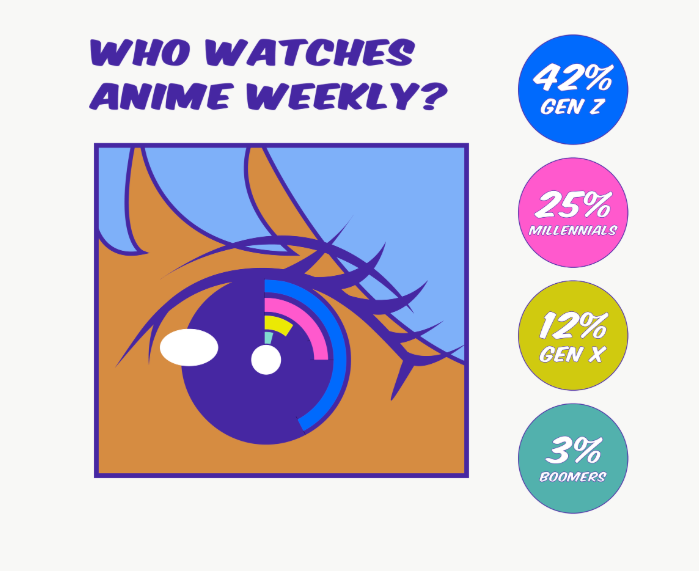

The numbers are striking. Adult animation leads Gen Z viewing, with 41% of 16–24-year-olds and 47% of 25–34-year-olds watching regularly, according to Hub’s most recent Monetizing Video study. Anime follows closely at 39% and 40% respectively—nearly double the general population average of 21%. According to a study by Polygon, 42% of Gen Zers watch anime weekly.

This isn’t just a trend—it’s a seismic shift in cultural priorities. Sports are scrambling to catch up. The LA Dodgers recently hosted a One Piece night (timed with Anime Expo, now the biggest annual convention in LA), acknowledging they need anime to reach younger fans—not the other way around. Anime viewership holds strong through age 34 (40%) before dropping off sharply to just 10% among viewers aged 35–74. Sports leagues are paying attention, launching similar activations to stay relevant.

Meanwhile, Crunchyroll reported 18 million subscribers in Q1 2025 and enjoys 60% awareness among 18–24-year-olds—higher than its 57% total awareness. Netflix and Hulu are all in on anime too, investing heavily in both licensed and original titles. Even athletes are getting in on it: 100m gold medalist Noah Lyles and NFL star Myles Garrett openly rep their anime fandom.

2. Anime isn’t a genre—and that’s its superpower.

Here’s where most platforms misread the room. Anime isn’t a genre. It’s a medium—one that includes everything from rom-coms to psychological thrillers to sweeping sci-fi epics. This flexibility became essential during COVID. While live-action TV leaned heavily on reruns and procedural comfort food, animation offered boundless creative variety. That’s exactly what Gen Z craves: a true spectrum of storytelling.

That versatility shows up in the data. It’s not just anime—it’s animation writ large. The broader animation boom is undeniable: adult animation leads among 16–24-year-olds (41%) and 25–34-year-olds (47%), while anime follows closely at 39% and 40%. Fantasy/Supernatural content also pops with Gen Z, pulling 40% of 16–24-year-olds and 42% of 25-34-year-olds, compared to just 28% of older viewers.

3. International content is the best fix for the YouTube problem.

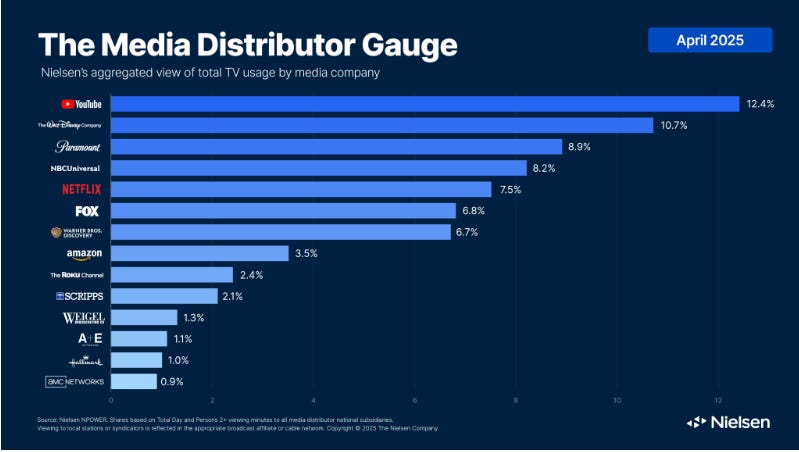

Streaming platforms have been leaking viewing share to YouTube for years, per Nielsen’s Gauge. Anime may be one of the few levers that can shift that dynamic.

Pure-play anime streamers like Crunchyroll and HiDive skew heavily male. K-drama service Kocowa, by contrast, leans female. That demographic targeting is a feature, not a bug.

According to Hub data, anime viewers are younger, more multicultural, and less affluent than the general population. That represents both challenge and opportunity—a growing, diverse audience that may require different monetization models than traditional premium subscribers.

The timing couldn’t be better. With the U.S. Census projecting a minority white population by 2045, anime’s resonance with multicultural Gen Z viewers positions it squarely for America’s demographic future. Platforms that build loyalty with this cohort now are future-proofing their base.

For streamers looking to diversify their audience, anime and international content aren’t just additive. They’re corrective.

4. The economics favor going global.

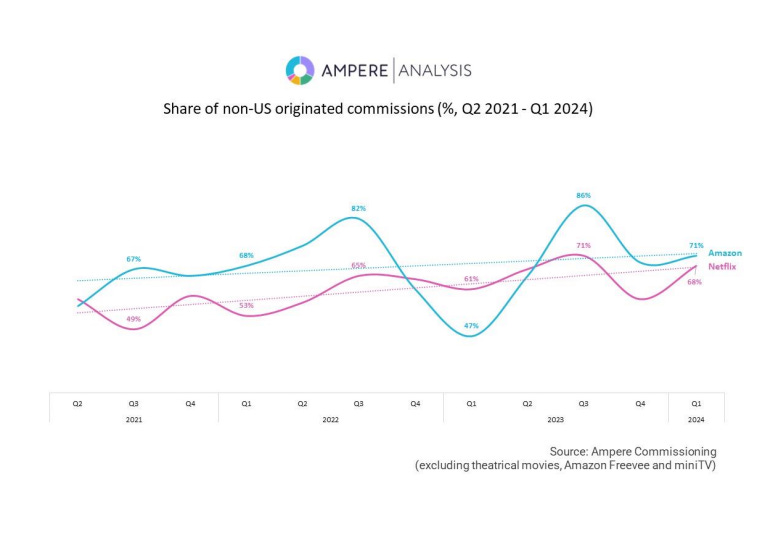

Follow the money, and the story sharpens. In Q1 2024, Netflix and Amazon commissioned the majority of their titles from outside the U.S., according to Ampere Research. Together, these two platforms accounted for 53% of all global SVOD commissions.

Why? U.S. production costs are high. The 2023 strikes caused lingering disruptions. And the domestic market is tapped out. Meanwhile, Netflix’s APAC region—home to 57 million subscribers and 4.3 billion potential viewers—drove 35% of the company’s subscriber growth in its last reported quarter. In Q2 2025, APAC gained 0.6 percentage points of Netflix’s total revenue, underscoring the region’s rising strategic value.

The Korean content boom proved this model works. From Gangnam Style (YouTube’s first billion-view video) to Squid Game and Parasite, the Hallyu (K-Content) wave has shown it can win critical acclaim and global audiences. Like anime, Korean content thrives on authentic storytelling within a distinctive cultural frame—proving that "foreign" doesn't mean "niche."

And the cost advantage is staggering. In a 2022 interview I conducted with Yuichiro Hayashi (director of Attack on Titan—then the most in-demand TV original globally, per Parrot Analytics), he was stunned to learn that Game of Thrones had a $15M-per-episode budget—roughly the entire five-season budget of Attack on Titan.

5. Gen Z is driving the international content wave.

According to Hub data, 39% of 16–24-year-olds watch anime regularly, versus just 10% of those aged 35–74—a nearly 4x gap. Fantasy/Supernatural content shows a similar split (40% vs. 28%). Crunchyroll’s 60% awareness among 18–24-year-olds proves niche platforms can break through if they’re dialed into their audience.

But this isn’t just about what Gen Z watches—it’s about how they buy. Gen Z's brand loyalties are still being shaped. That makes now the critical moment to engage. Miss it, and platforms risk losing a generation to competitors who already understand the assignment.

6. Scale matters. But specialization wins.

Yes, Netflix and Amazon dominate by scale. But niche platforms are finding success through curation and community.

Crunchyroll’s 18 million subscribers (as of Q1 2025) proves there's room for specialized players—if they understand their audience deeply enough.

Retention backs that up: According to Hub’s most recent Battle Royale study, Crunchyroll was the least likely platform to be canceled among Gen Z (18-24-year-olds, with a 60% retention rate.

Both anime and K-content follow the same basic playbook: deep cultural authenticity combined with universal themes. But execution matters. Crunchyroll built its brand on anime mastery. K-content thrived through mainstream integration. Both models work—but both require understanding that “international” doesn’t mean “low-cost.” It means different. And that difference is the draw.

The challenges are real—but solvable.

Licensing headaches. Cultural sensitivity. Subbing, dubbing, and global infrastructure. These hurdles are real—but they’re operational, not strategic. AI is already solving localization problems. And the audience is already there.

The bigger risk? Standing still while competitors seize the future.

What this means for streamers:

For the giants: International content isn’t just a growth lever—it’s an efficiency play. Lower costs + bigger markets = better unit economics.

For niche players: Focused expertise creates defensible moats. Crunchyroll and Kocowa show how depth beats breadth.

For advertisers: Gen Z’s global content habits offer rare access to engaged, hard-to-reach segments. The audience is watching—and they’re watching closely.

The future of streaming isn’t going global. It already is. Platforms that treat anime and international content as foundational—not supplemental—will win the next generation of viewers.

Because Gen Z isn’t choosing subtitles over English. They’re choosing authenticity over familiarity. And that’s a trend worth betting on.

Douglas Montgomery is a 20+ year veteran research and analyst in the entertainment and retail space. In 2021, Douglas founded Global Connects Media, where he serves as CEO. Global Connects Media aids its clients in gaining access to the world entertainment and retail market through strategic insights and research. Additionally, he serves as Asia Market Advisor for Parrot Analytics, the entertainment industry’s premiere AI-infused data provider.

Going to This Conference? Come Say Hi 👋🏼

Cynopsis ScreenShift NYC: October 14, 2025 (NYC)

Panel: Winning with Live TV: Revenue, Reach, and Rights Optimization

Tuesday, October 14, 2025 11:35 am-12:00 pm (ET)

As live TV continues to dominate ratings, the race to capitalize on this high-stakes content has never been more competitive – or more complex. This panel will explore how networks, sports leagues, and digital platforms are driving revenue with live content – from evolving rights deals, the rise of streaming and hybrid models, in-game and tentpole event advertising innovations, audience engagement strategies, and live betting integration. Panelists, including Hub’s Jon Giegengack, will also examine the role of data, direct-to-consumer subscriptions, and regional vs. global monetization approaches.

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub research on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies, to gaming, music, podcasts and social video. Working with the largest networks, pay TV operators, streaming providers, and studios, Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com