The Flop Factor

Unpacking the metrics that separate breakout box office hits from theatrical flameouts.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

The Flop Factor

One of the many reasons The Sopranos ushered in a new golden age of storytelling was the sheer novelty of a main character engaging in honest self-reflection. Let’s be real: looking inward with a critical eye is tough for any of us, let alone a hardened mob boss. But there was Tony, week after week, on Dr. Melfi’s couch, circling the idea of being a better person.

As difficult as it is, it’s long past time for Hollywood to do the same. The domestic box office has slipped from its pre-COVID highs of $11 billion-plus to under $9 billion since 2021. Even in 2025, ticket sales are ~23% behind 2019’s pace, per Comscore. To borrow from George Costanza: desperate times call for desperate measures.

While Tony ultimately chose to abandon self-reflection, Hollywood doesn’t have that luxury. By breaking down why recent high-profile flops failed, we can surface valuable lessons for navigating today’s moviemaking minefield.

Pre-Release Flop Tracking

Looking at the biggest box office bombs from 2021–2024, three through lines stand out:

1. Prestige & auteur misfires

2. Brand/star power miscalculations

3. Superhero meltdowns

Identifying the early indicators of each can help studios strengthen their pre-release warning system.

Prestige Misfires

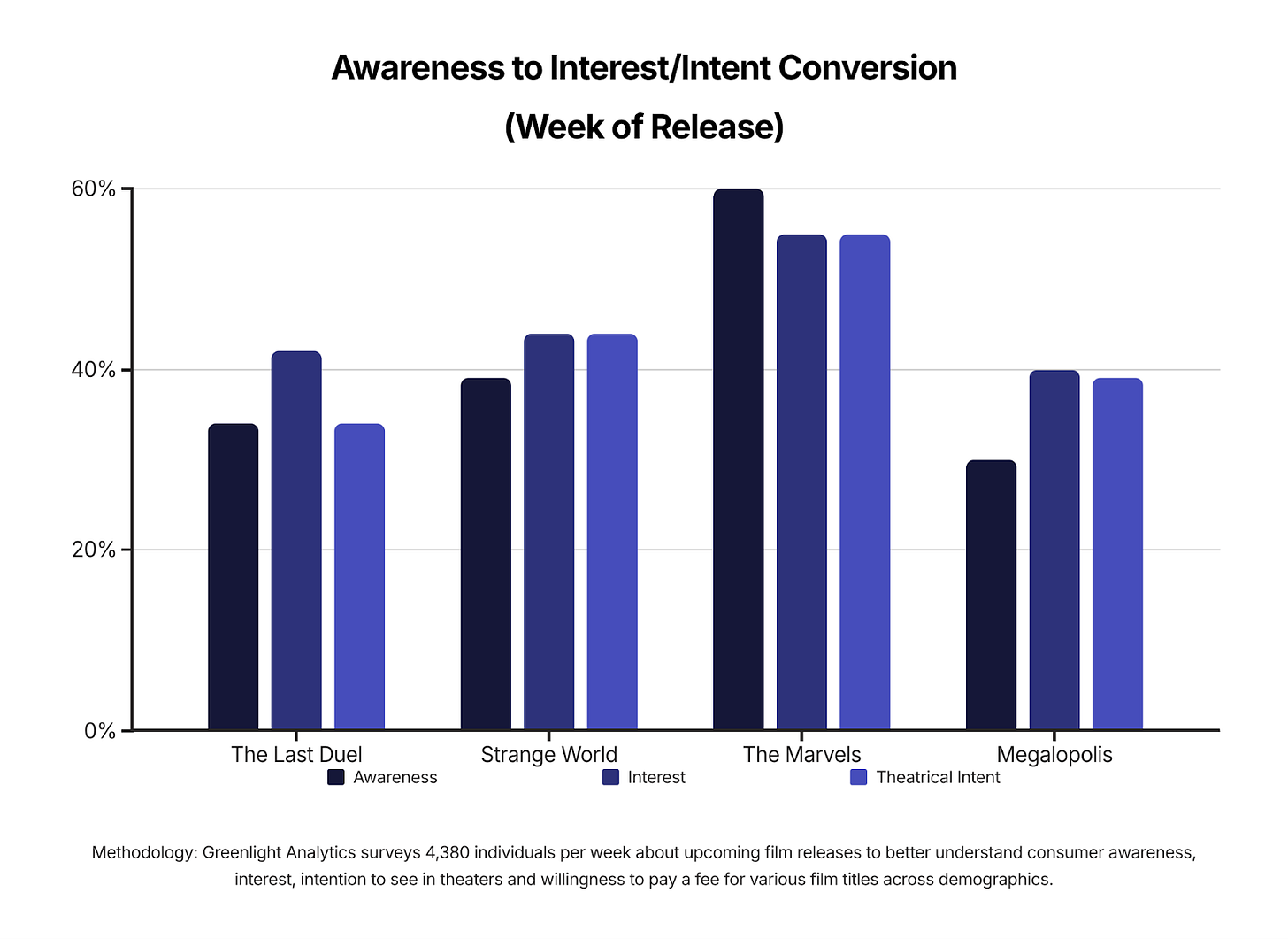

Ridley Scott’s The Last Duel grossed less than $11 million domestic against a $100 million budget. Steven Spielberg’s West Side Story remake fared only slightly better at $39 million. Both films were well-reviewed but faced pandemic headwinds. More telling: The Last Duel showed weak female conversion and low theatrical intent, per Greenlight Analytics. West Side Story skewed older with little traction under 35. Both trends spelled limited turnout. Fast-forward to Francis Ford Coppola’s Megalopolis, which bled an estimated $75.5 million after failing to attract beyond a niche male cinephiles. Critical pedigree wasn’t enough to drive broad interest.

Brand/Star Power Miscalculations

Disney’s Strange World lost an estimated $197 million. The star-studded Amsterdam bled $108 million despite Margot Robbie, Christian Bale, John David Washington — and even a Taylor Swift cameo. Once a stabilizing force, Disney’s family brand couldn’t overcome stagnant awareness and low intent (same story with Wish and Elio). Meanwhile, Amsterdam’s ensemble cast did little to boost willingness-to-pay or interest scores. Both were early red flags.

Superhero Meltdowns

Disney, Warner Bros. and Sony have all taken their lumps recently thanks to the estimated write-downs of The Marvels ($237 million), The Flash ($155 million), Joker: Folie À Deux ($144 million) and Kraven the Hunter ($71 million). Ouch. In each case, sky-high awareness never translated into intent and studios failed to activate female/family audiences.

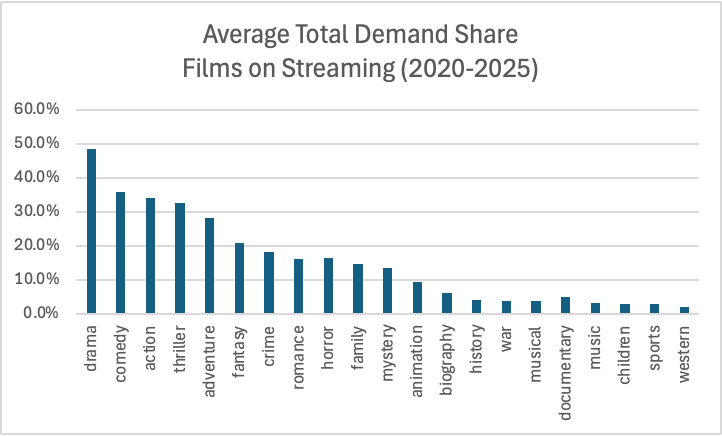

Streaming Shifts

Let’s zoom out a bit. From 2020 to today, Parrot Analytics data shows that, by average demand (a proxy for title-by-title success rate), Music films (A Complete Unknown, Taylor Swift: The Eras Tour, the upcoming Springsteen: Deliver Me From Nowhere) and Comedy have taken the steepest drops, while War films climbed the most in the rankings. Looking at genre share of demand each year (a measure of overall impact), Westerns and Sports consistently held the smallest slices, while Drama and Comedy dominated the largest.

Raw awareness and recognition mean little without purchase intent. To break through the streaming stasis, audiences need a reason to leave the couch. Historical dramas, musicals, auteur epics, animation, and superhero films can still succeed theatrically — if they match current moviegoer appetites, spark interest through targeted promotion, and deliver something creatively fresh.

According to Greenlight, films that land among the year’s top 10 domestic grossers typically open with Awareness around 65%, Interest at 57%, Intent at 55%, and WTP (Willingness to Pay) at 66%. Failing to do so is hardly a death sentence, but may mean you’re not destined to make the big bucks.

Home vs. Theaters

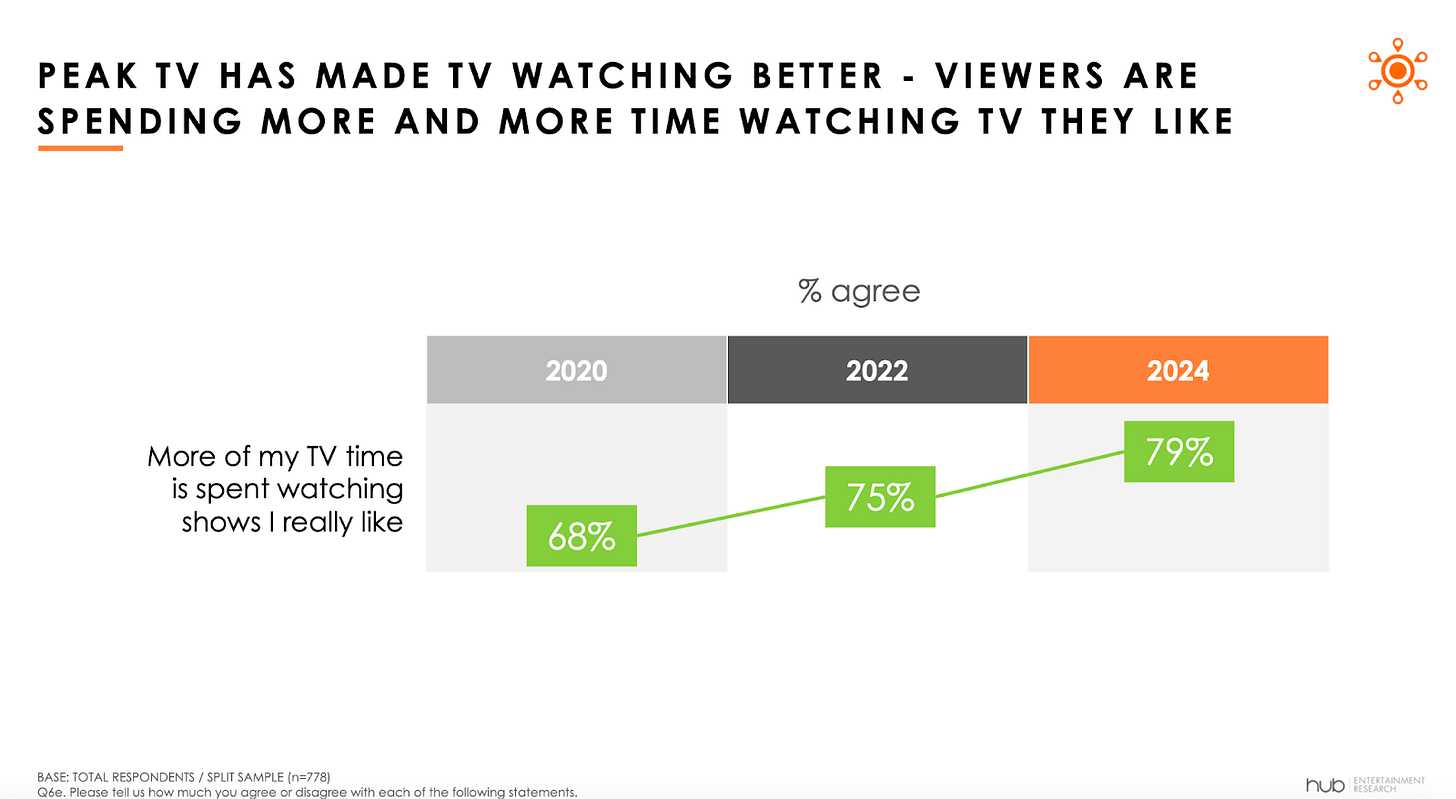

Some of these struggles can be traced to poor quality or ineffective marketing. But we’d be as foolish as a protagonist at the start of their hero’s journey if we ignored the larger behavioral shifts at play. The pandemic accelerated the move away from theaters and toward at-home entertainment, raising the bar for commercial viability.

According to Hub’s Conquering Content study, the share of people who said they’re spending more of their time watching TV shows they enjoy rose from 68% to 79% between 2020 and 2024. Hard competition to ignore. The same study also found that while theatrical movies on streaming have become less important to a platform’s perceived value, 20% of viewers still strongly prefer to wait until a movie hits their favorite streamer.

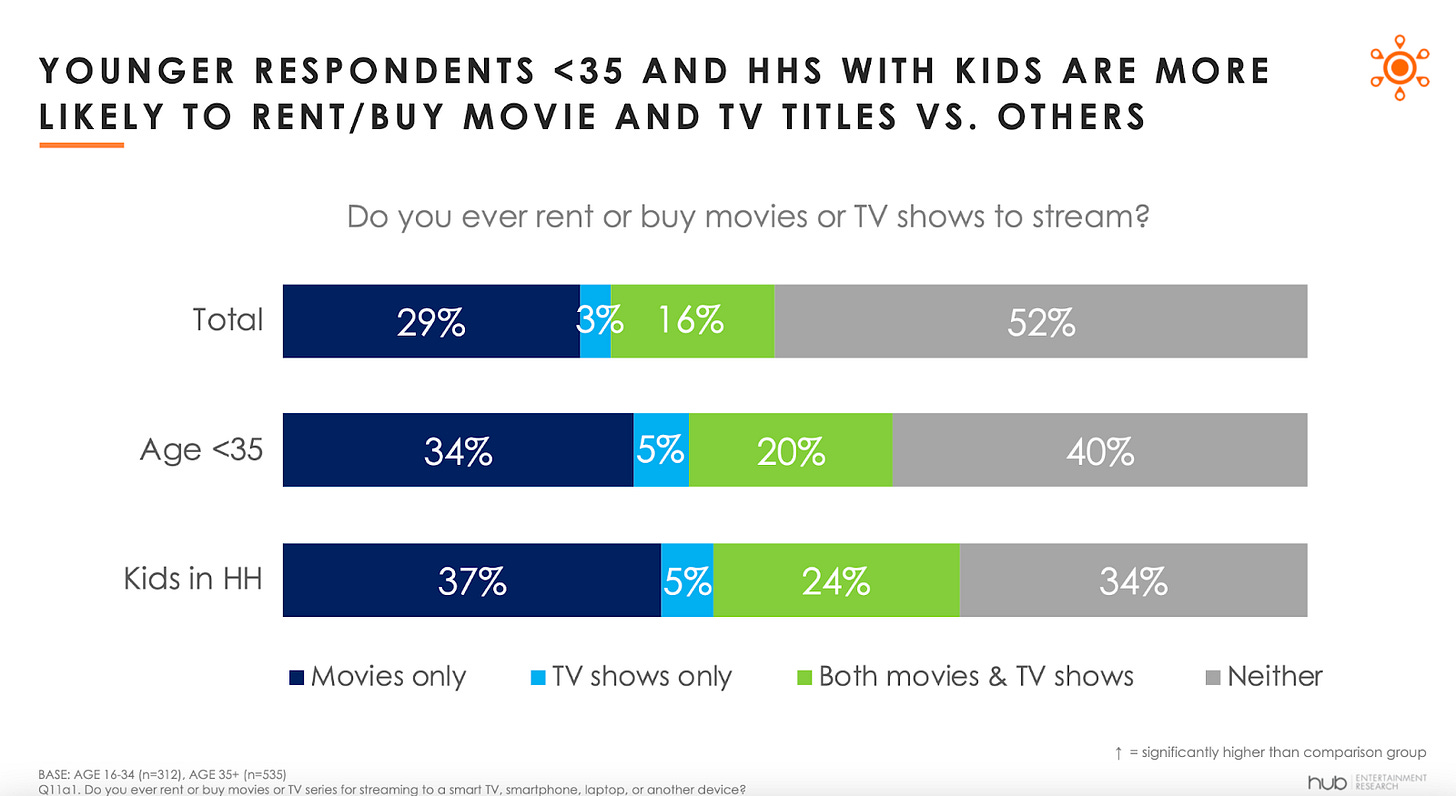

Piggybacking off that point, the VOD market has grown. The share of households renting or purchasing TV and movies at home rose from 12% to 16% over the past year, per Hub’s Monetization of Video study. Younger audiences and families — the very demographics theaters are chasing — were the most likely to rent or buy.

These insights help explain why Greenlight’s pre-release tracking for both disappointments and hits often shows softer interest scores, with WTP outpacing theatrical intent. It’s not just about quality or marketing — it’s about a fundamental shift in how we consume entertainment.

Lessons Learned for Studios

Theatrical breakouts in recent years share common DNA:

Younger/family-skewing IP (Five Nights at Freddy’s, The Super Mario Bros. Movie, A Minecraft Movie, Lilo & Stitch)

Cultural resonance with underserved audiences (Barbie, It Ends With Us, Sound of Freedom, Twisters, Sinners)

Event-driven nostalgia/conclusions (Spider-Man: No Way Home, Deadpool & Wolverine, Beetlejuice Beetlejuice, The Conjuring: Last Rites)

Fandom enthusiasm (Taylor Swift: The Eras Tour, Kpop Demon Hunters, Demon Slayer: Infinity Castle)

Premium spectacle in large formats (Top Gun: Maverick, Avatar: The Way of Water, F1: The Movie)

Relying on prestige, brand/star power, or popular genres alone will just get you roasted on Film Twitter. The notable flops since 2021 highlight what’s really needed: balanced demographic appeal, strong awareness-to-intent conversion, and a counterweight to what streaming is and isn’t supplying. Make it a priority to give non-core demos a reason to engage with your movie while still doubling down on your top audience target. Keep telling good stories.

C’mon, Hollywood. Use this opportunity to look inward and fix what’s broken!

Brandon Katz is the Director of Insights & Content Strategy at Greenlight Analytics where he focuses on evaluating the ever-fluid media landscape to unearth understanding, opportunity and value. Greenlight Analytics is the entertainment intelligence consulting company redefining how Hollywood finds, understands, and activates audiences. Prior to joining Greenlight Analytics, he served as the senior entertainment industry strategist at Parrot Analytics, and as a full-time entertainment industry reporter covering the Xs and Os of Hollywood, most notably with TheWrap and the Observer.

ICYMI: Hub in the News

New Research from Hub: Viewers Turn to SVODs as the “Starting Gate” for Streaming

“The data is clear: being a viewer’s default dramatically increases the likelihood they’ll keep you. First-stop status drives more sessions, more time spent, and higher retention. That’s why the battle for the TV home base is the most important fight in today’s entertainment landscape.” — Christina Pisano, consultant at Hub and one of the study authors.

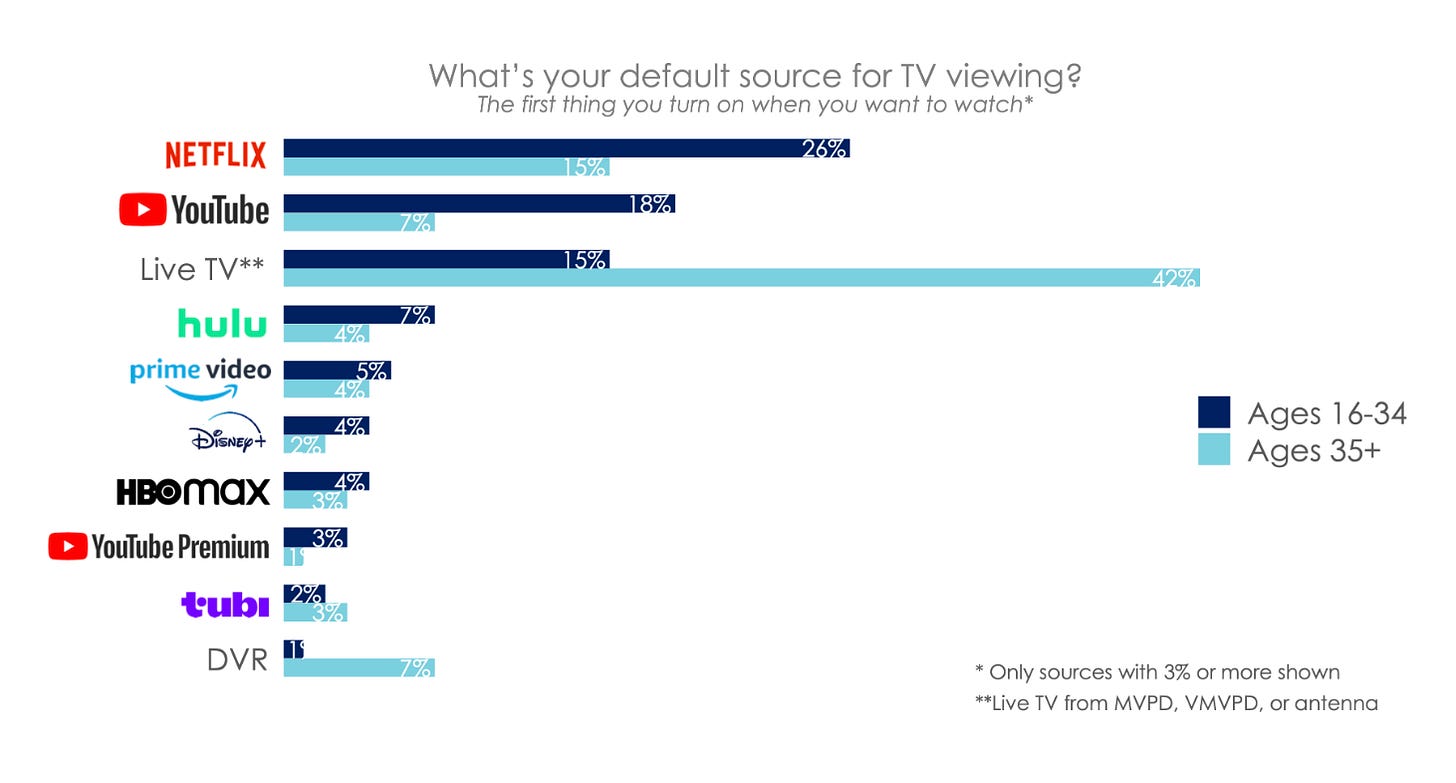

Today, consumers typically use four or more streaming services. For providers, reducing churn is now the top priority—and engagement has become a stronger indicator of brand health than subscriber counts. Since 2013, Hub’s annual Decoding the Default survey has measured which platforms consumers consider their “home base” for TV – the ‘first thing they turn on’ when they want to watch TV content. Here are nine takes on that research.

StreamTV Insider: Netflix is the default starting platform when customers turn on their TVs

Cynopsis: Cynopsis 09/16/25: New Study Shows Crowded TV Ecosystem

The Streamable: Viewers turn to streaming first, but loyalty remains tricky

CSI Magazine: SVODs overtake live TV as viewers’ default starting point: research

The Ankler: More AMAZON TV Exec Tumult

MediaPost: Streaming Starting Up More Viewer Sessions Vs. Live?

Too Much TV Newsletter: Too Much TV: PMC Makes Cuts At Rolling Stone, Including TV Critic Alan Sepinwall

World Screen: Hub: SVOD Emerges as Consumers’ “Starting Gate”

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub research on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies, to gaming, music, podcasts and social video. Working with the largest networks, pay TV operators, streaming providers, and studios, Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com