MyBundle and the Power of Personalization in Streaming: A Deep Dive

Uncovering the surprising viewing habits and regional trends shaping the way America streams.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

MyBundle and the Power of Personalization in Streaming: A Deep Dive

At MyBundle, we're here to simplify streaming. Through partnerships with over 270 broadband providers, we serve 13.5 million internet customers, helping them find their ideal streaming setup in an ever-expanding world of TV options.

To date, more than 1 million of those customers have used the Find My Bundle tool to find their perfect streaming package, tailored to their specific programming and budget needs.

Along the way, they have shared valuable information with us including who’s watching, how they watch, where they live, and the channels they can’t live without. All that information has given us unique data on individual preferences and some fun insights into regional preferences and trends over time. Here’s a look at some of our most interesting findings, revealing what matters most to our users across the country.

Live Sports

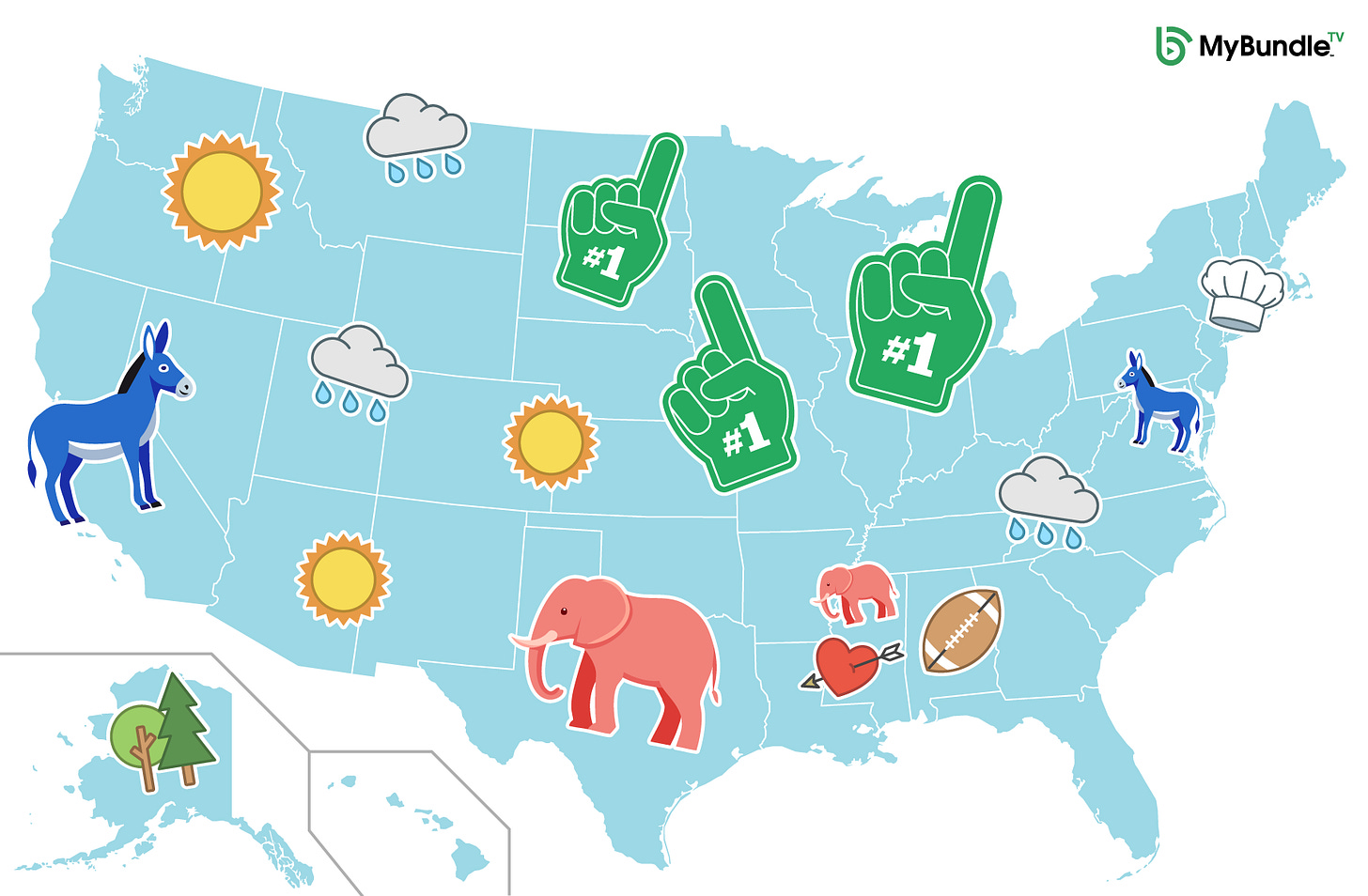

Midwesterners are 8% more likely to prioritize live sports than East Coasters, and 10% more than Southerners and West Coasters. Although Alabama tops the list as the most sports-obsessed state with both Roll Tide and War Eagle energy.

News

People in Mississippi (80%) and Texas (79%) rank FOX highest in the country as an essential channel. In contrast, viewers in DC and California gravitate toward MSNBC, with 37% and 29% citing it as necessary.

Lifestyle

When it comes to romance, Mississippi leads, with a notable percentage devoted to Hallmark Channel. The nature lovers in Alaska favor National Geographic, while Food Network is a must-have for the foodies in Connecticut, indicating that no two states are quite alike in their viewing priorities.

Trends

College sports channels like ESPNU, SEC Network, Big Ten Network, and ACC Network are climbing in popularity, while networks like CW, AMC, and TNT are seeing declines—highlighting the constant shift in viewing preferences.

The Weather

Some things, however, stay the same. For example, every single month, precisely 17% of MyBundle users indicate the Weather Channel is essential.

Bigger Households Mean More Channels

Another pattern emerges when we look at household size: the more people in a household, the more channels they request. “Just Me” households average 12 channels, while “Very Large Families” need about 22. Unsurprisingly, singles are far less likely to need DVR, suggesting a bit more freedom over their viewing schedules than their multi-person counterparts. Streaming preferences are also evolving: more households are shifting to smart TVs over Amazon Fire Sticks.

The Value of Individualized Bundles

If there’s one overarching insight, it’s this: streaming is intensely personal. 41% of households need between 1-10 channels, 30% need 11-20, 15% need 21-30, and 14% need over 30.

Last quarter, there were 399 different channels that at least someone, somewhere needed. Throughout the history of the service, there have been 548.

Furthermore, even with all the channels the big live TV streaming services offer, no streaming service gets recommended by our engine more than 30% of the time to satisfy all of a household’s live programming, sports and local channel needs.

This underscores what we’ve always believed: the right bundle is unique to each household.

At MyBundle, we’re here to help every user discover their own perfect mix. Because in the world of streaming, the best bundle is the one that’s tailored to you.

Michael Goldstein, MyBundle CRO, has marketed everything from orange juice and spaghetti sauce to online trading platforms to wholesale domain name registration services. Over fifteen years at internet pioneer Tucows, he launched and grew Ting Mobile, a multi-carrier MVNO, and Ting Internet, a fiber provider in about twenty markets around the country. He lamented not doing enough to help internet customers understand their video options and joined MyBundle to do it at scale.

Going to These Upcoming Conferences? Come Say Hi 👋🏼

Streaming Media Connect: November 12 -14, 2024 (Virtual)

Hub’s Jon Giegengack will be on a panel moderated by Evan Shapiro discussing Emerging OTT Subscription Strategies.

TVOT NYC: November 21, 2024 (New York City)

Battle of the Bundles: Why Streamlining Subscriptions Wins Over Today’s Consumers

Thursday, November 21st, 2024 | 1:45pm

Between TV, movies, gaming and music, people are using more entertainment subscriptions than ever. So many in fact that complexity has become their biggest challenge. In this session, Hub Entertainment Research Founder and Principal,

, will present an exclusive first look at the latest wave of Hub’s Battle Royale study, which tracks the biggest needs of consumers in the subscription economy. Then, will lead a panel of experts to discuss the biggest opportunities to use bundles to attract and keep subscribers.Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com