Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Password Sharing Crackdowns Are Here

It’s often said that all good things must come to an end. And for video consumers, it’s the end of watching a streaming service by borrowing someone else’s login. Another cliché that applies here is “it’s an ill wind that blows no good,” because while this is bad news for freeloading consumers, it could spell good revenue news for SVODs. It’s not hard to imagine the dollar signs in the eyes of streaming services. According to Hub’s TV Churn Tracker, 25% of TV viewers admit to using an SVOD with someone else’s credentials.

In response to this epidemic, Netflix was the first major streamer to come down on password sharing last year and Hulu’s password crackdown began in March. Soon to follow will be Max, expected to begin its password enforcement this fall and Disney, starting “in earnest” in September.

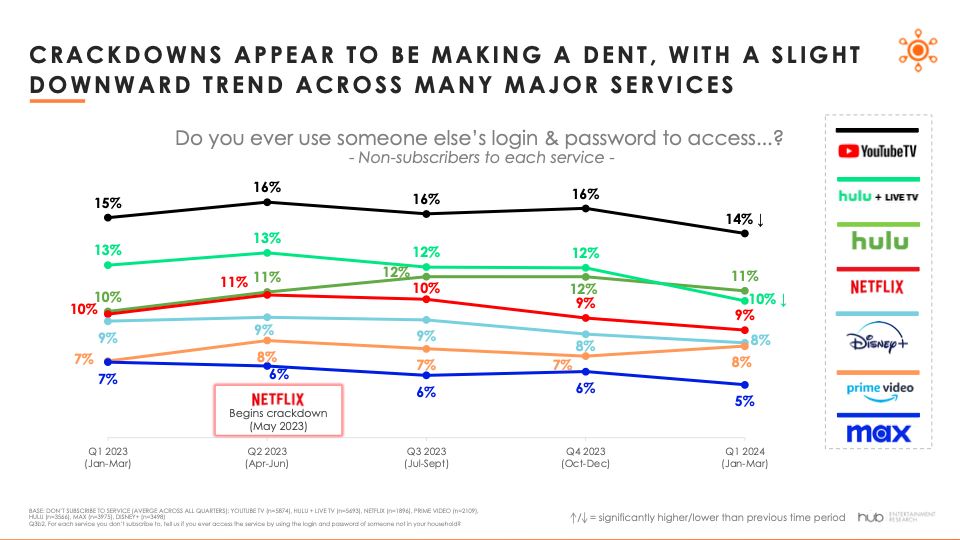

And so far, the results of the Hub TV Churn Tracker show the enforcement efforts appear to have had an effect on password sharing, resulting in a modest downward trend.

But when most of the major SVODs continue to lose hundreds of millions of dollars each year, is password enforcement a panacea or just nibbling around the margins? The important question is whether or not password sharing crackdowns will have a long-term effect on streamers’ subscription rates. Will consumers be driven to sign up for their own subscriptions if they can no longer piggyback on someone else’s, and if they do, how loyal will they be?

Here a few data points to consider:

Viewers who use others’ passwords are more likely to be younger, non-white and have kids. As noted in previous Hub reports, the sharers’ demographic profile suggest they are viewers who care a lot about TV, and avail themselves of a number of sources.

Password sharers are actually paying for a lot of subscriptions. It’s a mistake to assume people who use another’s SVOD password do it because they are reluctant to pay for TV. When it comes to paid subscriptions, more than 4 in 10 of this segment pay for a hefty 6 or more TV services. And among MVPD and vMVPD subscribers, the password sharers are also much heavier users of premium cable channels. In fact, they are heavier users of nearly all sources of TV, both paid and free, compared to those who do not share passwords.

The password sharers are also heavy churners. Here’s the challenge for subscription services: The password sharing viewers are more than 3 times as likely to add or cancel TV services in a typical month, compared with those who do not share. And there’s strong evidence the password sharers are “serial churners" -- 2 out of 3 who added a subscription were returning to a service they subscribed to in the past.

For password sharers, it’s also about cost. As always, content is a driver of additions and cancellations, but for password sharers, it’s also about cost. The top reasons for password sharing consumers to add a TV service are specific content, as well as amount of content. But subscription costs were cited nearly as often as a driver of sign-ups.

For SVODs, it’s a case of you gotta do what you gotta do.

It may seem like ancient history now, but it wasn’t that long ago subscriber growth was robust throughout the video marketplace. With revenue growth virtually assured for major streamers like Netflix and Disney+, services could afford to ignore rampant password sharing; Netflix even encouraged sharing, treating it as a marketing tool.

But indeed, all good things must come to an end, and market share gains became more difficult to come by. It was inevitable the streamers would come down harder on free riders. And not for nothing, but consumers are not entitled to consume content they have not paid to watch, particularly when profitability is still a way off for many media companies.

That said, password enforcement won’t be a game changer for subscription rates.

Make no mistake, password crackdowns have started to drive down sharing and result in a net positive effect on subscriptions. And that means revenue gains.

But the evidence from the TV Churn Tracker suggests the gains will be incremental, not substantial. The challenge is the password sharers profile as quintessential serial subscription churners – young consumers who have a lot of TV subscriptions already, and are looking for value. So when they do subscribe to a service, it’s likely they won’t stay with it very long.

The sharers are already maxed out on their TV spending, and if they add a service, they will be dropping another one to do so. The one bright spot for the streamers is most of these consumers return to services they have canceled, if the content attracts them.

With SVODs under pressure to deliver profitability and manage production costs, password enforcement is an imperative, even if it delivers only incremental revenue.

ICYMI: Hub in the News

Fans are Open to Sports on Streaming, But Worry Their Games Will Be Harder to Find and Watch

“The reputation streaming brands have built delivering scripted TV has earned them goodwill when it comes to sports. But that goodwill doesn’t come without strings attached: network TV still benefits from the inertia of familiarity, one which individual streamers will need a longer track record to match. Plus, fans are already wary their sports will become more confusing to find – a problem which will be even more frustrating with live sports because it’s critical to find and watch them immediately.” —

, principal at Hub and one of the study’s authors.The latest report from Hub Entertainment Research reveals that sports fans are open to more sports and games becoming available on streaming platforms. Leveraging findings from the second wave of Hub’s What’s the Score: The Evolution of Sports Media, here are 7 takes on the research:

Sports Pro Media: US fans still think traditional TV is more reliable for live sports than streaming

StreamTV Insider: ESPN aims to turn sports fragmentation into touchdown

TheDesk: Sports fans open to streaming, but still favor broadcast TV

Newscast Studio: Sports streaming gains, but viewers struggle with fragmentation

Media Play News: Hub: Sports Fans Open to Live-Streaming Events, Games

Yahoo Sports: Fans Cheer Rise of Streaming Sports, Worry That Games Will Be Harder to Watch

TVTechnology: Fans Cheer Rise of Streaming Sports, Worry That Games Will Be Harder to Watch

Going to This Upcoming Conference? Come Say Hi 👋🏼

NYC TV Week: September 10, 2024

Hub’s

will be speaking at NYC TV Week on September 10. Join him and a series of industry experts for insights and updates on the biggest topics impacting professionals in the business of TV.Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com