FAST and Antenna Viewers Aren’t Just About the Free

Viewers of free TV sources are also a critical pay TV segment

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

FAST and Antenna Viewers Aren’t Just About the Free

Over the past several years, the rollout of free, ad-supported streaming TV (FAST) offerings has been nothing short of astounding. A recent report identified nearly 2,000 such channels in the U.S., an increase of nearly 50% in just the past two years. And what once seemed the province of TV set OEMs and minor video players now includes big media companies like Fox (Tubi), Paramount (PlutoTV), and Amazon (Amazon Live) among the well-established FAST services, with each reaching nearly one-third of TV viewers.

If you build it…

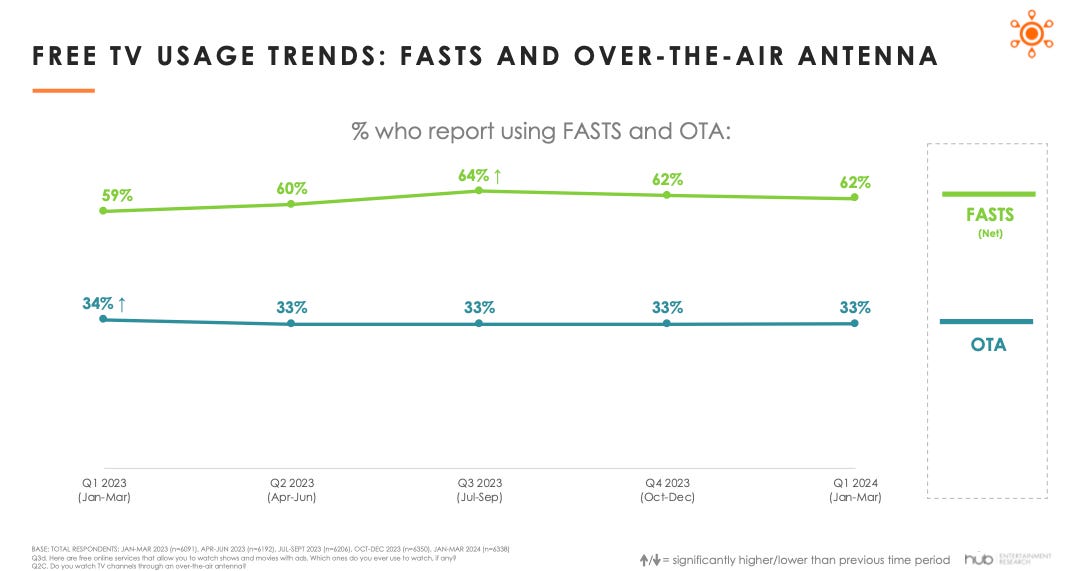

The proliferation of FAST offerings has led to widespread usage among U.S. consumers. While the share using FASTs has plateaued over the past couple of years, they are still reaching nearly two-thirds of U.S. TV viewers. And for individual FAST services, there remains considerable opportunity for growth. The Hub TV Churn Tracker identified nearly 40% of FAST viewers who reported trying a new channel in the previous month.

At the same time, old-school broadcast antenna usage continues among one-third of TV consumers. Across FASTs and antenna, 7 in 10 viewers use a free TV source in a typical month, either streaming or over-the-air – more than one-third use a FAST only, 25% use both sources, and 1 in 10 uses an antenna only.

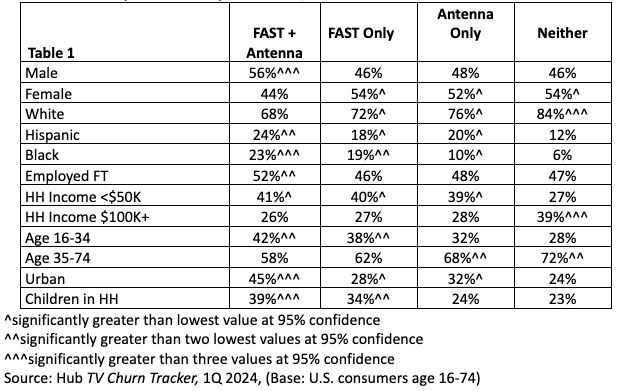

Also of note, viewers who use both free sources are demographically distinctive – they are more likely to be younger, Male, Black or Hispanic, Urban, lower income, and have children.

Table 1 (below) displays demographic differences among viewers who use both a FAST and an antenna, those who use only a FAST or only an antenna, and those who use neither*

Don’t think free TV viewers are cheapskates, or that they don’t care about TV

FAST viewers shell out for more SVOD subscriptions, and those who also view with an antenna use the most diverse array of video sources. More than 7 in 10 FAST users subscribe to 3 or more SVODs, and those who also use an antenna are more likely to subscribe to 3 or more outside the Big 5 of Netflix, Hulu, Max, Disney+, Amazon Prime Video. The free TV viewers using both FASTs and an antenna also far surpass other consumers in subscribing to premium cable channels.

And good news for advertisers – FAST viewers are also significantly more likely to use SVOD services with ads and without ads.

Given such high rates of SVOD and premium channel subscription, it’s pretty obvious the “free” in FAST isn’t likely a primary driver of usage for most of these consumers. It’s more probable these video omnivores are enjoying FASTs and over-the-air broadcast as two more sources they can add to their already robust TV menus.

Table 2 (below) displays differences among viewers who use both a FAST and an antenna, those who use only a FAST or only an antenna, and those who use neither in their viewing of TV*

They also avail themselves of one other source of “free” viewing – password sharing

The FAST+antenna viewers are much more likely than other viewers to use another person’s password to watch. As SVODs crack down on password sharing, how will this group’s overall subscription and viewing patterns be affected? Will they pay for these subscriptions to continue viewing or will they simply stop watching?

The way the free viewers churn through TV services suggests they will pay for a service if they can no longer piggyback on another subscription, but they may not be loyal to it long term.

“Adders,” and “swappers,” and “droppers”, oh my!

The labels “swappers” and “serial subscribers” accurately describe the FAST+antenna consumers. They are by far the most likely to have both added and dropped a service in the past month, and two-thirds of the adders were coming back to a service they had previously canceled.

Table 3 (below) displays differences among viewers who use both a FAST+antenna, those who use only a FAST or only an antenna, and those who use neither in adding and canceling TV subscriptions.*

BUT – It’s not that cost doesn’t matter to the free viewers…

Like nearly all viewers, free TV viewers are driven by content offerings when they add a service. But the FAST+antenna viewers are considerably more likely to be attracted by price promotions. With lots of subscriptions already, lower incomes and larger families, it makes sense these consumers are looking for bargains where they can find them.

By the same token, these FAST+antenna viewers also cancel when they are no longer getting the value and use out of their TV subscriptions.

The free TV viewer paradox – they are a critical target for pay TV services

It would be easy to stereotype free viewers as people who don’t care about TV or cannot or will not spend to receive it. But the evidence shows the opposite — the free viewers clearly value TV content, and seek it out whenever and wherever they can. And they have plenty of paid subscriptions.

But the challenge for the streaming services is that these consumers are the most active “adders” and “droppers.” They are swapping out one subscription for another when they run out of content (or worse for the streamers, when a price promotion ends).

The solutions of course are obvious, but not easily (or inexpensively) implemented. It would be straightforward to simply produce more content and spend more to market it. But that isn’t the world we live in, where belt-tightening is the rule in the video ecosystem, not the exception.

What to do, what to do…

If streamers aren’t going to throw around production and marketing money, they will need creative solutions to attract and keep these restless subscribers. Services will need to ensure subscribers know about exciting new content through menus and recommendations, of course. But if they aren’t going to spend more on messaging, they’ll also need to develop more efficient marketing plans to reach subs off-platform.

For the FAST providers themselves, this may result in an advertising bonanza, provided they agree to sell to competitors. Targeting FAST users is one obvious means for streaming services to communicate with consumers most likely to add or return to a subscription.

🏁 Don’t Miss Live Debate Club: “Show Me Your Bundle”

Four debaters, four bundles. Only one winner. 🏆 It's time to put users in the driving seat when it comes to bundling.

Join Hub’s

Meet the four debaters who agreed to take on the challenge:

Douglas Montgomery, Global Connects Media

, Hub Entertainment Research

, Eshap

Alan Wolk , TV Rev

Moderated by , The Local Act /

BYOB(undle) to share in the chatroom.

🗓 Tuesday, July 30th at 9am PT / 12pm ET

Register here.

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

About Hub Entertainment Research

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com