Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

IP-ocalypse Now

Like fashion, entertainment runs on trends and fads. And just like low-rise jeans, some trends stick longer than they should. But eventually, everything cool has its comedown.

Movie franchises are no exception. Intellectual property—novels, comics, video games, sequels, prequels, spinoffs, reboots—is a magnet for mass audiences across big and small screens. But even the most bankable franchises aren’t immune to burnout. Audiences are savvier than ever, and franchise fatigue is real.

Which begs the question: how do franchises evolve—or decline—in today’s crowded content landscape?

Disney Franchise TV: Too Much of a Good Thing?

There’s a reason the saying “too much of a good thing” sticks around. Ice cream’s great—but eat it every day and, well, you know. Same goes for franchise TV.

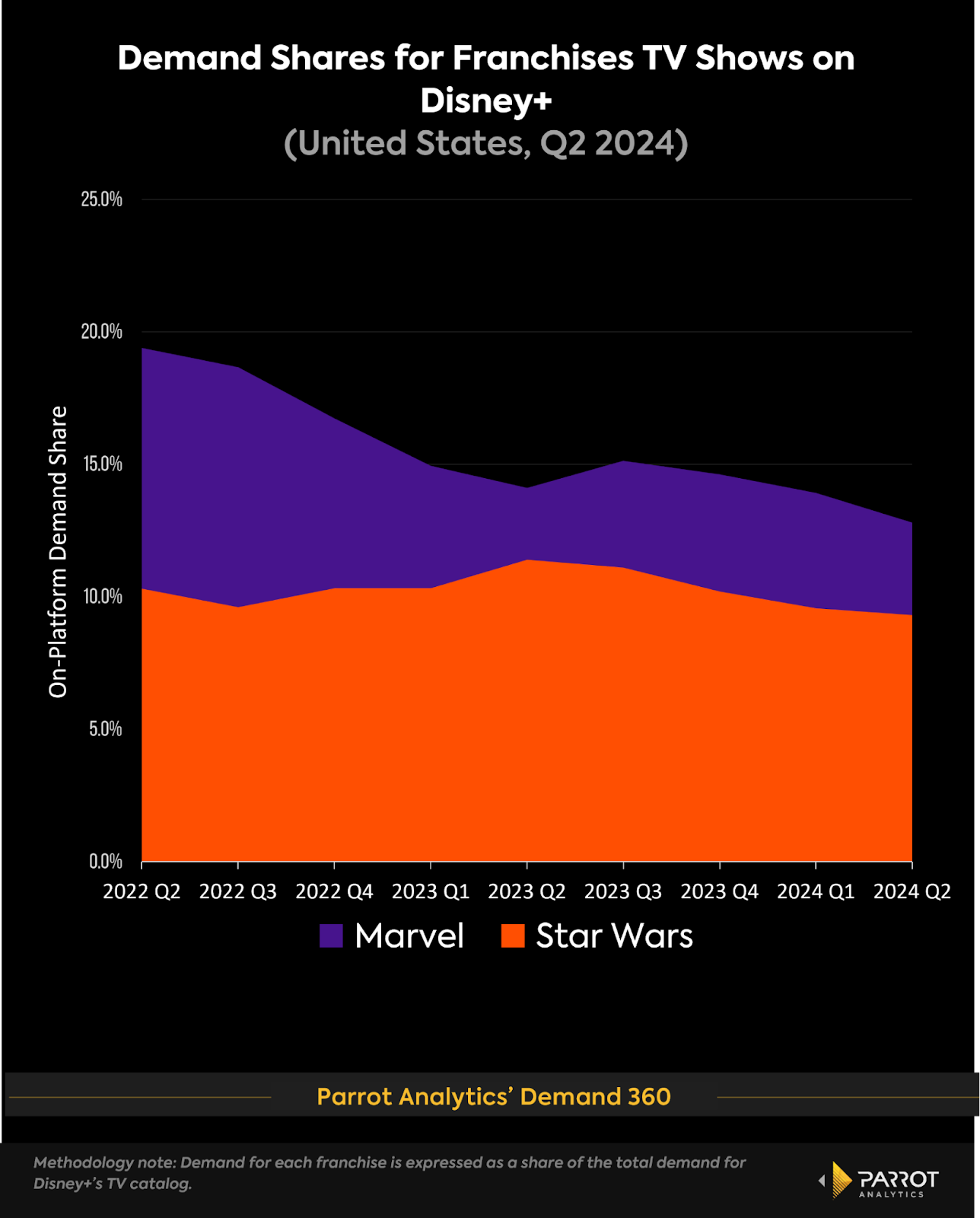

According to Parrot Analytics, Marvel’s share of Disney+ audience demand dropped from 19.4% in Q2 2022 to 12.8% in Q2 2024. Star Wars dipped too, though less dramatically—from 10.3% to 9.3%. Combined, the two still make up over 22% of Disney+ demand while accounting for just 12% of its catalog. That’s impressive... but also a warning sign.

The gap between output and excitement is widening. A glut of content and uneven quality has taken some of the shine off. It’s possible Andor’s return and Ironheart this summer could help turn the tide. But right now, Disney’s most expensive franchises are facing diminishing returns.

Missing the Gen Z Mark

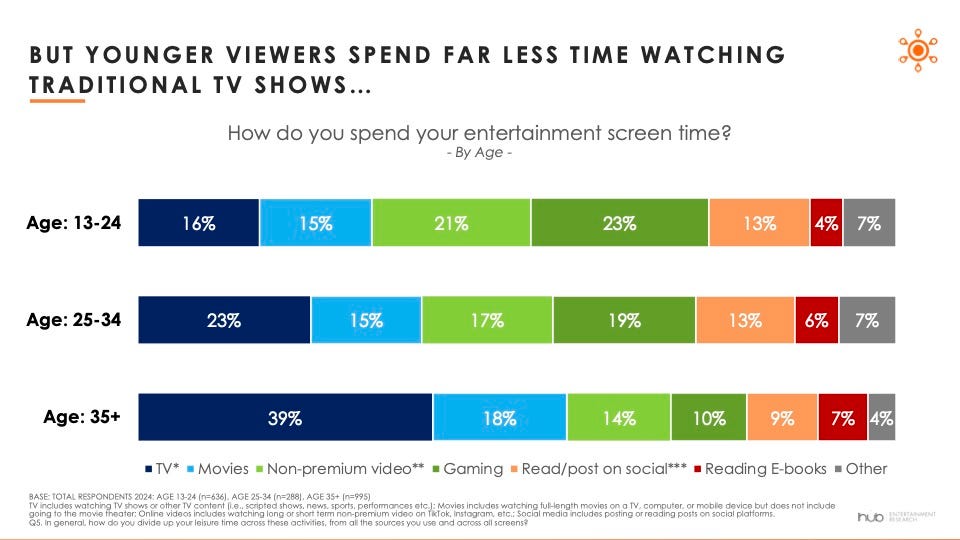

This should concern anyone trying to win over the next generation of spenders. Viewers 13-24 aren’t engaging with traditional entertainment the way older demos do, according to Hub’s Video Redefined study. These are, as Schmidt from New Girl might say, “the youths from the statistics.”

Instead, they’re gravitating toward short-form video and gaming. That means beloved IP from older generations may not carry the same weight. To click with Gen Z, Hollywood needs either IP that already speaks to them (The Last of Us, Minecraft) or content that mirrors how they watch. Yes, 60-second dramas are having a moment—just don’t tell the dearly departed Quibi.

Consider Jurassic’s Recurring Sequels

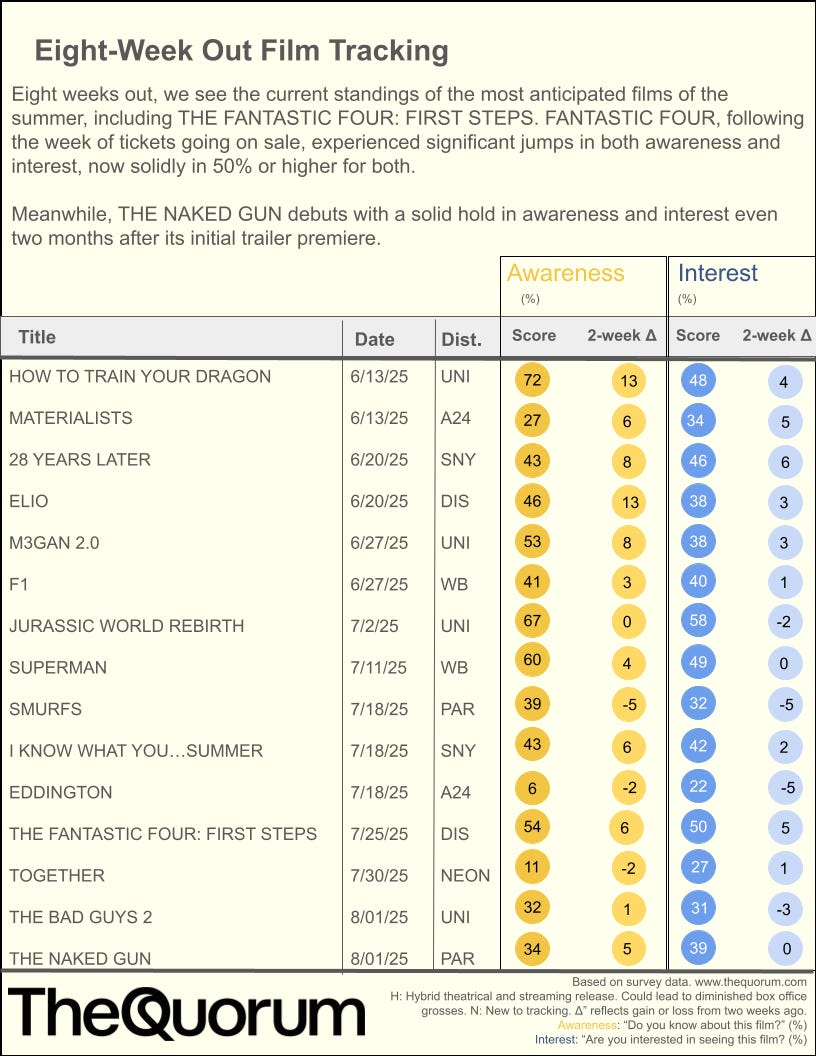

Six weeks prior to the release of Jurassic World: Rebirth, awareness (74%) and interest (59%) were tracking well, according to The Quorum’s pre-release data. But only 53% of respondents plan to see it in theaters, compared to 61% for Jurassic World: Dominion at the same point.

What was driving this early drop? Could be Dominion’s poor reception (29% on Rotten Tomatoes). Could be franchise fatigue, with Rebirth arriving just three years later. Or maybe no Chris Pratt equals no box office magic. Even with Scarlett Johansson, Mahershala Ali, and Jonathan Bailey on the call sheet, Rebirth still had ground to cover early in its promo campaign.

Bottom line: franchise performance today isn’t just about brand awareness. It’s about perceived value. That’s why metrics like willingness to pay and theatrical intent are becoming the new gold standard for measuring franchise health.

Platform IP Strengths: Not All IP Is Created Equal

IP isn’t one-size-fits-all. And where it lives matters.

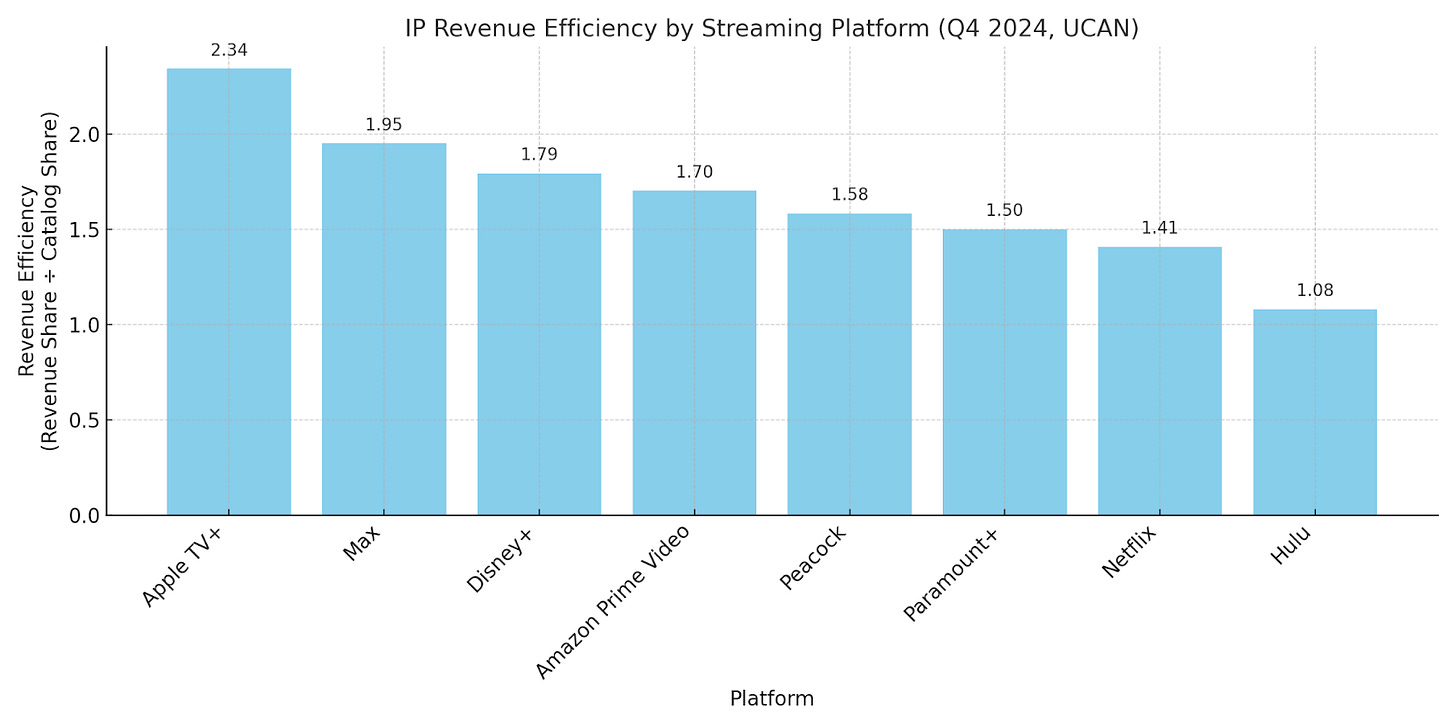

In Q4 2024, Apple TV+—a streamer with a small library and minimal legacy franchises—saw titles based on IP generate 2.3x the estimated streaming revenue relative to their share of catalog, according to Parrot Analytics. Its biggest hits? Literary adaptations like Killers of the Flower Moon and Foundation.

Conversely, despite Disney+’s deep bench of franchise IP, its estimated revenue efficiency may have hit a ceiling. Not to pick on the Magic Kingdom, but audiences are showing a renewed appetite for originality, at least when it comes to certain aging brands. Novelty—especially when it feels fresh and un-franchised—is cutting through the noise. Even the biggest war chests of familiar characters can’t guarantee growth if viewer interest is shifting elsewhere.

Meanwhile, IP origin plays a major role in how audiences show up. Book-based IP (think Harry Potter, DC Comics, Reacher) has a built-in fanbase, but straying too far from the source risks backlash.

Original IP (John Wick, Yellowstone) can grow into massive universes with the right creative spark. Around 70% of Yellowstone viewers also tuned into a spinoff, according to Hub’s Conquering Content study, implying that in-universe expansion is quite attractive when executed properly. (There’s a reason why Taylor Sheridan is the hottest showrunner in Hollywood right now). But spinoffs must be calculated carefully, as the John Wick franchise string-pullers now learn. Peacock’s The Continental was a flop and Ballerina justified itself creatively but may not recoup its production and marketing costs.

Then there’s the evergreen sequel/prequel/spinoff treadmill (Marvel, Fast & Furious)—still effective, but showing signs of age. And finally, real-event IP (true crime, biopics, sports docs) continues to resonate, especially with adult audiences and can tap into relevant current events or nostalgia.

The Franchise Fix: Evolve, Don’t Expire

The goal is to keep franchises fresh for as long as possible. That requires more than churning out content—it means rethinking what success looks like and how to get there.

Step one: eventization. Every installment needs to feel like a must-see moment. Spider-Man: No Way Home cracked the code by uniting three generations of Spidey and sending fans into a multiverse frenzy. That kind of cultural lightning doesn’t strike without intentional planning—and real stakes.

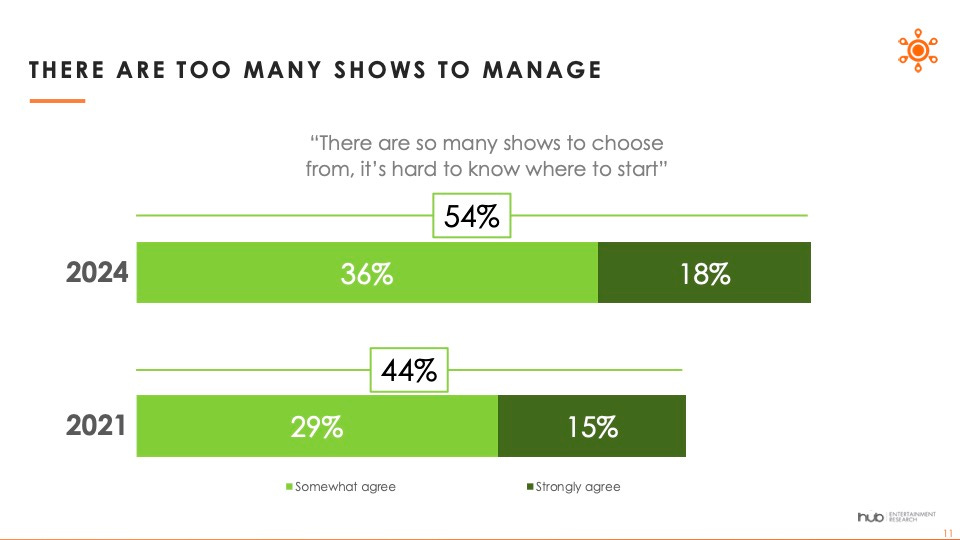

Streaming, for all its volume, can dilute that sense of urgency. But it can also be a powerful tool to keep IP top of mind. Discovery remains one of the biggest pain points for viewers. So, smart surfacing of legacy titles can go a long way. Warner Bros. played it right with Dune: Part II, boosting anticipation by strategically streaming the first film across HBO Max, Hulu, and Netflix in the lead-up to release.

Franchise fatigue isn’t a death sentence. It’s a signal. A sign that the audience has changed—and it’s time for the content (and the playbook) to change with them.

Because just like fads, IP isn’t dead when the buzz dies down. It just needs a reboot—with purpose. Franchises aren’t guaranteed paydays; they’re long games that demand care, curation, and the occasional course correction.

No overhaul needed—just a new mindset.

Brandon Katz is the Director of Insights & Content Strategy at Greenlight Analytics where he focuses on evaluating the ever-fluid media landscape to unearth understanding, opportunity and value. Greenlight Analytics is an audience-first media research firm that helps companies master the art and science of audience viewership, acquisition and retention. Prior to joining Greenlight Analytics, he served as the senior entertainment industry strategist at Parrot Analytics, and as a full-time entertainment industry reporter covering the Xs and Os of Hollywood, most notably with TheWrap and the Observer.

ICYMI: Hub in the News

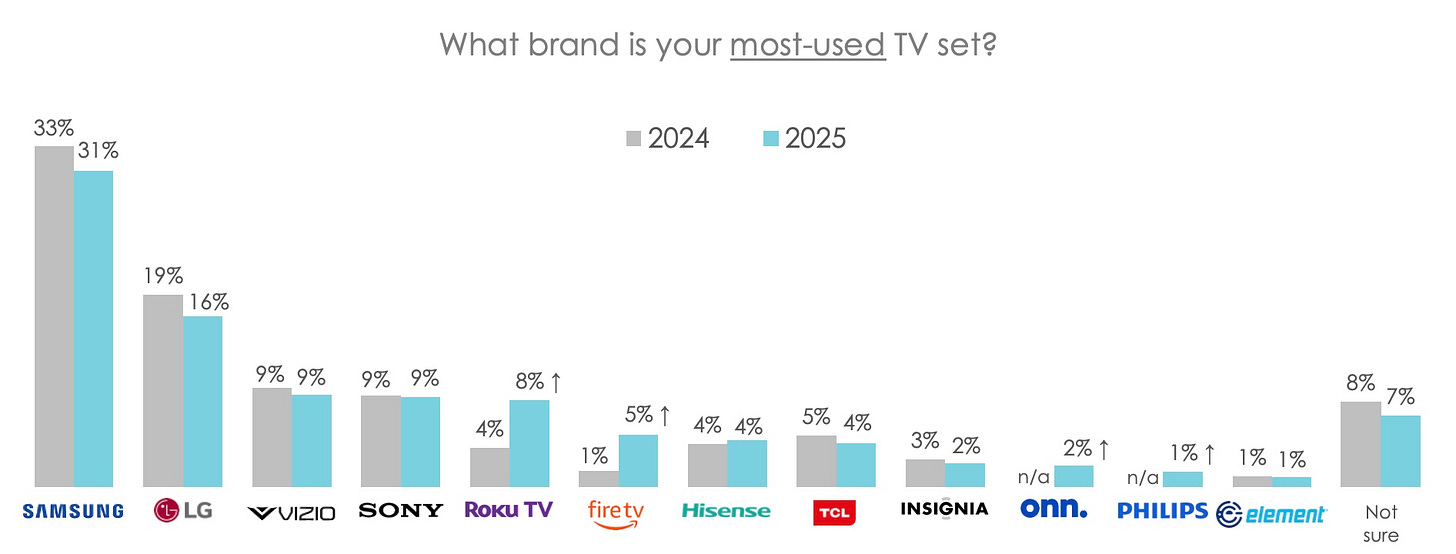

New Research from Hub: Smart TVs Reign as Future Entertainment Centers

"Without a single TV operating system dominating the market, each has the opportunity to better promote streaming services and AI-viewing enhancements to make things easier for viewers. The challenge of finding a good show to watch is not just about too many services to choose from; it’s about finding a TV operating system that simplifies those choices in a way that works.” —

, Senior Consultant at HubUS homes now own an average of two smart TVs – dominated by LG and Samsung – but Roku and FireTV continue to make headway in 2025. How exactly are users leaning into new TV features and content on their "most-used" TV set? Hub’s annual Evolution of the TV Set study revealed that the fragmented TV landscape provides opportunities for TV brands to break out with new applications that will win viewers. Here are seven takes on the research.

TV Technology: Average U.S. Home Now Has Two Smart TVs

Advanced Television: Research: TVs becoming more than just for TV viewing

StreamTV Insider: Roku, Amazon see biggest gains for US consumers’ most-used smart TV brand

MediaPost: Smart TV Growth Creates New Opportunities For Brands And AI, Says Hub Research

TheDesk.net: Hub: Samsung, LG remain dominant in U.S. homes

Newscast Studio: Smart TV ownership rises as Roku and Fire TV gain traction in U.S. homes

Senal News: USA: Smart TVs reign as future entertainment centers

Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub research on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies, to gaming, music, podcasts and social video. Working with the largest networks, pay TV operators, streaming providers, and studios, Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com