Streaming Wars: Why City Dwellers Are Outpacing Suburban and Rural Viewers

How Urban audiences are driving the future of TV subscriptions.

Welcome to Hub Intel. We’re here to provide data, not drama. Our goal is to help you understand the trends in the entertainment industry and what they mean to your business.

Streaming Wars: Why City Dwellers Are Outpacing Suburban and Rural Viewers

In a presidential election year, we become almost immune to the constant chatter about “blue” and “red” states. But it’s not and never has been as simple as that. U.S. voters in every state cast ballots in precincts or counties that tilt Democratic or Republican. And it’s often the population density of those precincts that tells us more about party affiliation than the state they reside in.

Where we live isn’t related to just how we vote, either. Marketers have been aware for years there are also differences in brand preferences between country and city folk. With such striking differences in how Urban and Rural Americans perceive brands, social issues, and political candidates in mind, let’s consider the question of whether or not there are also distinctions in how they subscribe to and watch TV services.

There are striking demographic differences between Urban and Rural viewers.

Across our Hub studies, which are balanced to the U.S. Census, roughly half our respondents self-identify as residing in Suburban areas, a third in Urban, and one sixth in Rural settings.

What really jumps out when looking at the demo profiles are the large differences between Urban and Rural viewers on gender and ethnicity. The Urban group exceeds the Rural group by double-digit margins in proportions of Male, Hispanic, and Black viewers.

The Urban viewers are also most likely to be younger, and have kids. In general, Suburban viewers are more similar to Rural viewers demographically, with the exception of income, in which Suburbanites lead all groups in percentage earning $100K+ annually.

Table 1 displays demographic differences among Urban, Rural, and Suburban viewers:

These are important differences because across all our Hub studies, we see subscription adoption and churn are especially high among Younger, Male, and Non-White cohorts who value TV more than other viewers do.

In fact, in Hub’s most recent Decoding The Default study, 61% of Urban viewers were significantly more likely to say TV is “essential” or “very important” to them, compared with only 50% among Suburban and 42% among Rural.

And sure enough we also found some other interesting things:

Urban viewers far outpace Rural and Suburban consumers on TV subscriptions and usage.

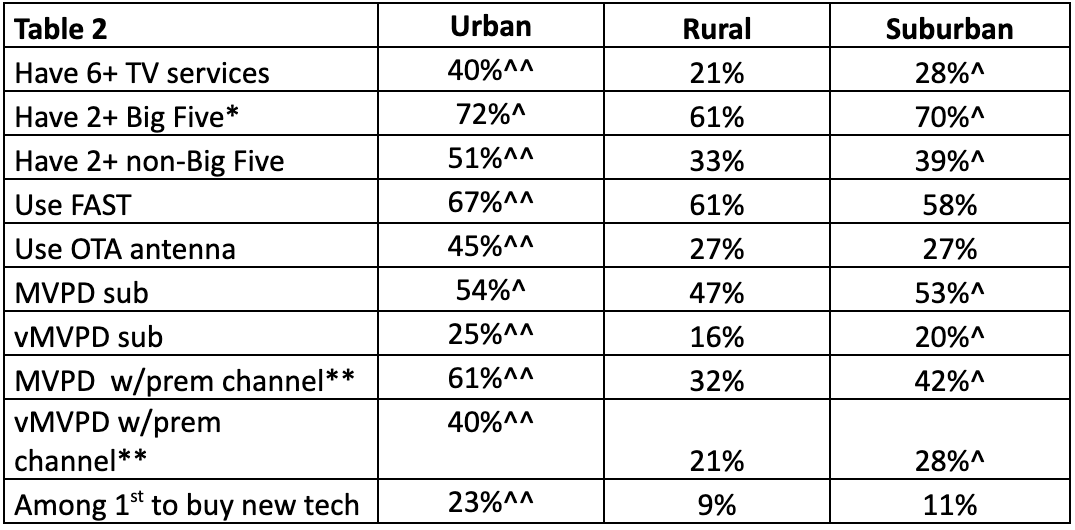

Urban viewers are more likely than Rural and Suburban viewers to use virtually all TV sources shown in the table below. In particular, they are nearly twice as likely as Rural viewers and almost 50% more likely than Suburban viewers to subscribe to 6 or more TV services.

Not only are Urban viewers more likely to pay for streaming services and premium cable channels, they are also more likely to use free alternatives like FASTs or an antenna. At first blush that looks like terrific news for TV streamers, but not so fast…

Table 2 displays differences in subscription and media usage among Urban, Rural, and Suburban viewers:

Urban viewers review and churn their subscriptions more than Rural and Suburban viewers.

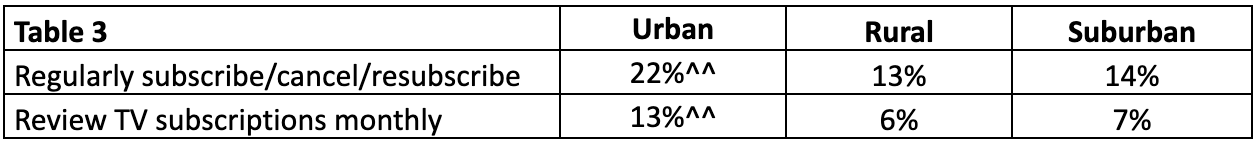

Sure, the Urban viewers have a lot more TV services. But they are also the most likely to review their TV subscriptions each month. And this leads them to be the most likely “serial churners.” Nearly 25% of Urban viewers regularly subscribe, cancel and resubscribe.

Table 3 displays differences in subscription churn among Urban, Rural, and Suburban viewers:

Urban viewers are the most likely to react positively to TV advertising.

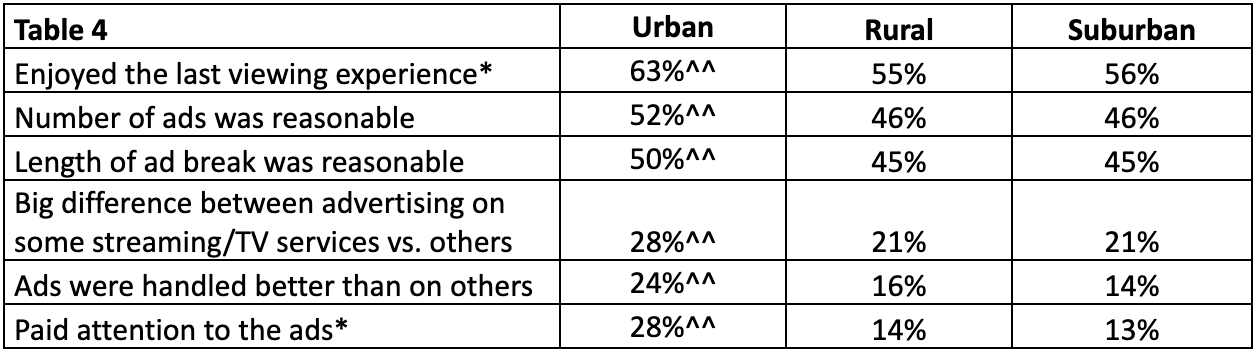

Hub has been working hard to bust the long-standing myth that TV viewers “hate advertising.” And in the past, the Younger, Male, Tech-Savvy Urban viewers would have seemingly fit the old stereotype of ad avoiders.

But guess what? Urban viewers were much more positive toward the ad experience in the ad-supported content they watched. They were the most likely to say the number of ads and length of breaks were “reasonable.”

More importantly for advertisers, the Urban viewers were also the most likely to have paid attention to the ads they saw. That’s the payoff marketers get for presenting viewers with a reasonable amount of ads.

Table 4 displays differences in attitudes toward their advertising experience** among Urban, Rural, and Suburban viewers:

What does all this mean for the video streamers? They need to pay attention to Urban viewers – they are the engine of the video ecosystem.

The third of TV consumers who live in Urban areas punch above their weight when it comes to their contribution to the streaming marketplace. They far surpass Rural and Suburban residents in the number of TV services they subscribe to. And why not? They are the most likely to value and enjoy TV.

But they’re restless consumers too. The centrality of TV in their lives makes them want more TV subscriptions, but it also means they pay attention to their arrays of subscriptions, and cancel when they aren’t getting value.

Geographically focused messaging to people in Urban areas via outdoor, local broadcast and cable, and geo targeted digital should be a no-brainer for streamers looking to tell lapsed subs to come back for new series or movies. With the services increasingly tightening budgets, focusing on TV-savvy Urbanites is an efficient use of resources.

Going to These Upcoming Conferences? Come Say Hi 👋🏼

ARF OTT 2024: October 23, 2024 (Los Angeles + Livestream)

Hub's

will present study findings where we will uncover the degree to which political attitudes and partisanship do (or don’t) influence what we watch for entertainment. Joining the discussion: Pedro R. Almeida (Mediaprobe), Brian Fuhrer (Nielsen), and Horst Stipp (ARF).NORTHERN WAVES TV CONFERENCE: October 24, 2024 (Oslo, Norway 🇳🇴)

Hub’s

is thrilled to be a part of Northern Waves TV, proudly presented by Norigin Media. As a keynote speaker, Jon will present the most important trends in TV over the past year from the surge of FAST channels and bundling to why sports rights are so expensive and the importance of a good user experience.Want More Hub Intel?

Hub Intel is a reader-supported publication. Become a paid subscriber to get access to exclusive Hub white papers and deep dives on key topics as well as admission to Hub’s webinars.

Hub Entertainment Research, which celebrated its 10th anniversary in 2023, tracks how technology is changing the way people find, choose, and consume entertainment content: from TV and movies to gaming, music, podcasts, and social video. Hub’s studies have covered the most important trends in providers, devices, and technologies since 2013. We work with the largest TV networks, pay TV operators, streaming providers, technology companies, and studios to assess the present and forecast the future.

Learn More: Visit our website

Follow Us: LinkedIn

Get In Touch: Email us at hubintel@substack.com

This is super interesting, thanks for this article!